The main thing on the cryptocurrency market

The volume of liquidations on the crypto market exceeded $398 million per day

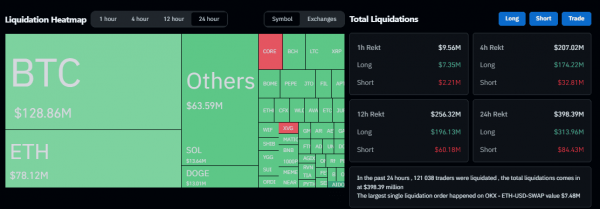

On the night of April 2, 2024, Bitcoin fell below $66,000, but subsequently the rate of the first cryptocurrency rose to almost $67,000. Over the course of the day, the price of the asset decreased by more than 3%. Against this background, the volume of liquidations on futures on the cryptocurrency market amounted to more than $398 million in 24 hours.

Over the last 24 hours, the positions of 121,038 traders were liquidated. Approximately $314 million in losses occurred on long positions, and almost $85 million on short positions.

The largest amounts of liquidations have traditionally been on the Binance and OKX cryptocurrency exchanges – $175.43 million and $137.54 million, respectively .

The largest liquidation of $7.48 million was recorded on OKX in the ETH/USDT trading pair.

At the time of writing the news, Bitcoin is trading at $66.8 thousand.

Argentina introduced a mandatory register of crypto exchanges and service providers

At the end of March 2024, the Argentine regulator announced the creation of a unified registry of virtual asset service providers (PSAV). Now companies and individuals whose activities are related to cryptocurrencies will have to undergo mandatory registration. Forbes reports this with a link to the text of the document.

According to the publication, the new requirement will apply to organizations offering the purchase, sale, sending or receiving of cryptocurrencies, trading in digital assets or lending services.

According to the document, the rules apply not only to local service providers, but also to firms operating in the Argentine market, but registered in other places.

“Anyone who does not register will not be able to provide services of virtual asset providers in country,” warned the President of the Argentine National Securities Commission (CNV), Roberto Silva.

It should be noted that the co-founder of the Money On Chain protocol, Manuel Ferrari, harshly criticized the CNV initiative. He stated that Bitcoin is money and not a security.

“It is a terrible idea to create a registry of companies involved in buying and selling Bitcoin. For example, currency exchange offices or jewelry stores do not need to register with CNV,” the expert said.

According to him, such an initiative can only be beneficial to lawyers and representatives of the regulator. Moreover, this event does not correspond to the position of President Javier Miley, who is considered a supporter of Bitcoin.

The founder of the KamiPay payment service, Nicolas Bourbon, believes that the regulation will not affect users in any way. In his opinion, it is aimed at meeting the requirements of international organizations.

According to the Chainalysis rating, Argentina ranks 15th in the global cryptocurrency adoption index. According to local crypto exchange Lemon, residents of the country continue to invest in Bitcoin amid record inflation. Demand for the first cryptocurrency in Argentina has reached its highest level in 20 months.

The weekly inflow into crypto funds amounted to $862 million

The analytical company CoinShares published a weekly report on the flow of funds in crypto funds. Experts noted the resumption of inflows into investment products.

According to available data, in the period from March 23 to March 29, 2024, the net inflow of capital amounted to $862 million. The leaders in terms of the volume of funds received are spot Bitcoin ETFs from BlackRock companies – $617 million, and Fidelity Investments – $610 million.

In third position is an investment product from Ark Invest and 21Shares with an indicator of $302 million. At the same time, the convertible fund of Grayscale Investments continues to demonstrate significant outflows. In the last reporting period, he lost $960 million.

As for the distribution of inflows across assets, Bitcoin retains primacy here. It accounted for $865 million of total financial investments in the sector. Second place in terms of this indicator was taken by Solana with an inflow of capital of $6.1 million. At the same time, Ethereum recorded an outflow of $18.9 million.

At the regional level, the United States remains the leader with an indicator of $897 million. Country demonstrates a significant gap in the inflow of capital into investment products compared to other countries. The second position remained with Brazil – $2.9 million, and third place is occupied by Australia with a volume of $1.5 million.

Binance revealed the composition of the first board of directors

Binance Holdings, which manages the crypto exchange of the same name, has formed its first board of directors. It included seven members, including the company's new CEO, Richard Teng.

According to a publication on the official website, the full composition of the company's board of directors is as follows:

- Gabriel Abed, former Ambassador of Barbados to the UAE . He is also the co-founder of the technology firm Bitt; new Binance CEO Richard Teng. He took office after Changpeng Zhao was relieved of his position. It is noteworthy that Teng had previously refused to disclose details about the company to reporters; company co-founders Heina Chen (CFO), Lilai Wang and Jinkai He; Arno Ventura, managing partner at the investment company Gojo&Co; Xin Wang, CEO of Bayview Acquisition Corp, specializing in mergers and acquisitions.

“The board includes seven members, three of whom are independent heads of other companies. We are proud to be advised by people from the leaders in the Web3 space as we move toward the next chapter of Binance’s development,” a representative of the exchange said in a comment to Cointelegraph.