The main thing on the cryptocurrency market.

Trading volume of spot Ethereum-ETFs exceeded $1 billion on the first day.

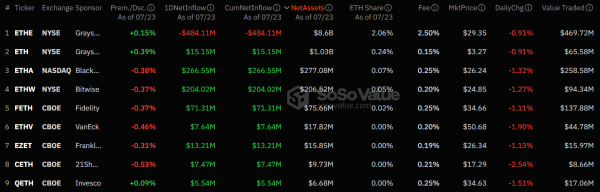

Yesterday, July 23, spot Ethereum-ETFs entered the US stock market. The trading volume in the sector amounted to $1.11 billion by the end of the day, the net inflow of capital was $106.78 million. This is evidenced by SoSo Value data.

According to the platform's data, at least some ETHE investors have moved their funds to Grayscale Investments' new product, the Grayscale Ethereum Mini Trust ETF (ETH). It leads other funds in terms of assets under management (AUM).

Ethereum responded to the situation with jumps, but the asset was never able to gain a foothold at the $3,500 level. At the time of writing the news, the price of ETH is $3458.

< h3>Kraken clients began receiving payments from the Mt. Gox

Clients of the Kraken platform spoke about receiving payments from the bankrupt cryptocurrency exchange Mt. Gox. They wrote about this on Reddit.

Most users expressed their joy after receiving the assets. Some said they increased their deposit by 110 times. Another user shared that he would use this capital to buy a house.

One of the discussion participants noted that payments to the Bitstamp crypto exchange have not yet arrived.

The largest mining company in the United States was fined $138 million

The largest mining company in the United States, Marathon Digital, was fined $138 million for violating an agreement not to circumvent the other party to the transaction. Cointelegraph reports this.

According to a press release provided to the publication by the law firm Affeld England & Johnson, the jury unanimously returned a verdict in favor of the founder of US Bitcoin Corp and the investment director of Hut 8, Michael Ho.

In 2020, Marathon management developed a growth strategy, including the launch of a large-scale Bitcoin mining facility in North America. The company implemented Ho's ideas without compensating him for providing confidential information.

Law firm partner David Affeld said the court's verdict underscored the importance of honoring obligations and choosing the right business partners.

“This is strong a signal that ethical business principles are not an option, but a necessity,” he added.

Marathon remains the largest mining company by capitalization with $6.99 billion. The company is significantly ahead of CleanSpark ($4.1 billion) and Riot Blockchain ($3.5 billion) that followed in the rating.

Swan Bitcoin will curtail its mining operations and will abandon the IPO

The CEO of the investment crypto company Swan Bitcoin, Corey Klippsten, announced his intention to curtail all Bitcoin mining operations and abandon plans for a public offering of shares (IPO).

According to the entrepreneur , the reason for the decision was the lack of opportunity to make significant profits in the short term.

Klippsten also noted that the change in strategy for the accelerated growth of Swan Bitcoin involves “reducing personnel in many areas.”

Swan Bitcoin launched a cryptocurrency mining division in the summer of 2023. In January 2024, the company stated that it had received 750 BTC since the start of mining transactions. The company's hashrate reached 4.5 EH/s, and its representatives intended to increase this figure to 8 EH/s.

Rate of Bitcoin, Ethereum, Litecoin and other cryptocurrencies.

- Cryptocurrency