The list on the website of the Ministry of Economy does not include McLaren, Alpina, a number of Mercedes-Benz models and many others, which, based on price criteria, should be subject to taxation.

In Ukraine, the list of cars whose owners must pay a “luxury tax” of 25 thousand UAH, for some reason many models are missing, some luxury brands in general, and there are also errors that can be used as a loophole for tax evasion.

About this says the story of the Bihus.Info project.

Journalists analyzed a document published on the website of the Ministry of Economy in February 2024. According to the analysis, the list of cars whose owners must pay transport tax this year does not include Ferrari cars.

According to the website auto.ria, these are the most expensive on the Ukrainian market cars. In particular, two Ferrari SF90 cars (2022 model year) are now selling for650 thousand dollars. and 800 thousand dollars. The second, more expensive car was part of the collection of 25-year-old millionaire Alexander Slobozhenko.

In addition, in the list on the website of the Ministry of Economy There are no Rolls-Royce cars at all. It is indicated that such machines are used by people's deputies of Ukraine. For example, people's representatives Stepan Ivakhiv, Suto Mamoyan and Gennady Vatsak were seen driving Cullinan crossovers.

Journalists noticed that Vatsak's confectionery house also owns a Rolls-Royce Ghost sedan and a Lamborghini Urus crossover. The car of this Italian brand is also not listed on the Ministry of Economy website.

Read the main ones news of the day:

- They will be populated by peasants from the Russian Federation: the demographer named a city in which there may be no Ukrainians left after the occupation

- Terrorist attack in Crocus City Holle” – ISIS sent a tough message to Putin: new details and “blunders” of the FSB

- Results of indexation of pensions: who was “under-indexed” and why – answers to 10 main questions

This list also generally does not include McLaren, Alpina, a number of Mercedes-Benz models and many otherswhich, based on price criteria, should be subject to taxation.

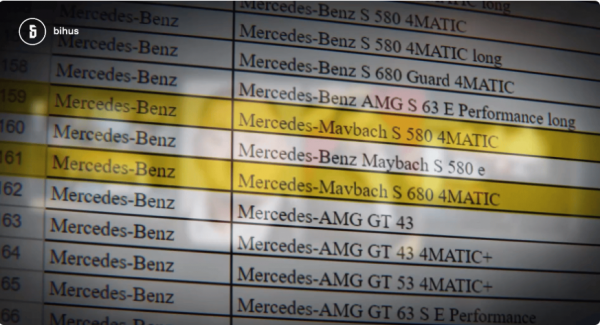

Bihus.Info also noted errors in the document on the Ministry of Economy website, which allow one to avoid paying tax even for those cars that are on the list. In particular, incorrect engine sizes are indicated for three Bentley models, and the names of Mercedes-Maybach sedans are indicated with an error – MaVbach.

Transport tax – what is it

The transport tax provides for the payment of 25 thousand UAH per year for owners of cars that are no more than five years old and whose average market value exceeds 375 minimum wages (in 2024 this is about 2.7 million UAH). The average market value of cars is calculated using a special formula.

The list of cars subject to taxation is prepared by the state enterprise Gosvneshinform. This list is published on the website of the Ministry of Economy. It indicates specific brands, models, engine sizes, age of the car, equipment or version for which you will have to pay. All this so that car owners understand that it is their vehicles that are subject to taxation.

By the way, earlier journalists examined the declarations of the heads of large cities and the heads of all Ukrainian government agencies, and compiled a rating of the owners of the largest vehicle fleets among regional officials.< /p>

Read also:

- New luxury cars and real estate for millions: what people’s deputies acquired during the war

- Salaries of Ukrainian officials for the first year of a full-scale war: journalists compiled a ranking of the richest

- What Ukrainians' taxes are spent on: the Ministry of Economy explained

Subscribe to our channels in Telegram and Viber.