The main thing on the cryptocurrency market.

The difficulty of Bitcoin mining has set a new record

As a result of the next recalculation, the difficulty of mining the first cryptocurrency increased by 5.79%. The indicator updated its historical maximum at the level of 83.95 tons.

The average hashrate during the period of preliminary change in value was 600.72 EH/s. The range between blocks is 9 minutes 27 seconds.

According to the Hashrate Index, the hash price (miners' income in terms of used computing power) is $0.11316 per TH.

< /p>

< /p>

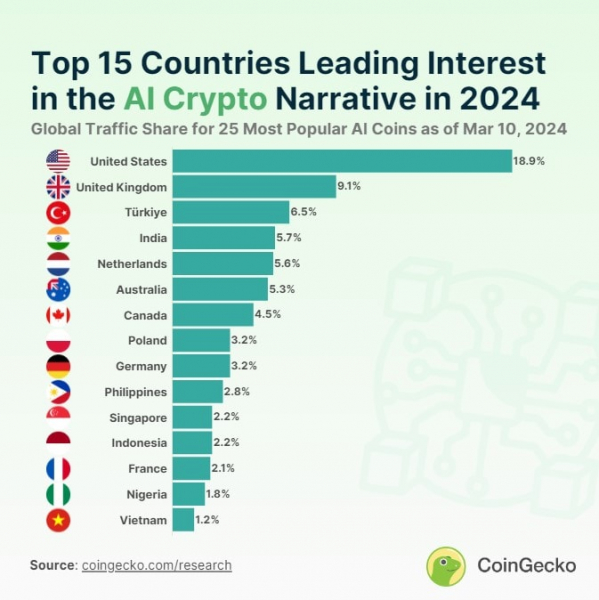

Countries with the greatest interest in AI-based digital assets are named

The team of the analytical platform CoinGecko presented a report on global interest in the field of digital assets based on artificial intelligence. Experts studied the distribution of search queries on this topic among the population of different countries.

According to the analysis, the leader in interest in AI cryptoassets is the United States with a share of 18.9%. The UK is in second place with an indicator of 9.1%. Turkey secured third place, reaching 6.5%.

Analysts note that in most countries that are leaders in the level of interest in digital assets based on AI, memcoins are also very popular. Residents of the USA, Great Britain, India, Canada and the Philippines are particularly active in this regard.

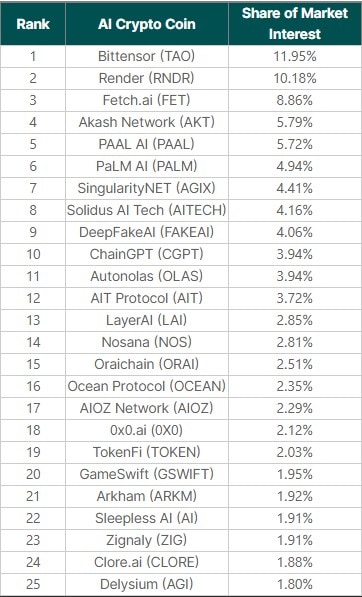

As for the most popular AI-based coins, Bittensor (TAO), Render (RNDR) and Fetch are in the top three. ai (FET). Experts note that these digital assets have a significant market capitalization and demonstrate progress in terms of price dynamics.

Among other popular AI-based coins, CoinGecko representatives indicated Akash Network (AKT), PAAL AI (PAAL), SingularityNET ( AGIX) and Ocean Protocol (OCEAN).

At the same time, analysts note the tendency of users to show interest in digital assets, in the name of which developers use the AI prefix. In their opinion, some developers are using this trend to promote their projects.

However, CoinGecko emphasizes that the use of this prefix does not guarantee the popularity of a digital asset.

The analysis takes into account web traffic by country on based on the 25 most popular coins based on artificial intelligence in the period from January 1 to March 10, 2024. Digital assets using bots were not included in the report.

The court refused to recognize Craig Wright as the creator of Bitcoin

British judge James Mellor ruled that Craig Wright is not Satoshi Nakamoto or the author of the Bitcoin white paper. This was reported by CoinDesk.

The Crypto Open Patent Alliance (COPA) case against Wright began in 2021. Then the organization filed a lawsuit against the businessman to prevent him from suing the developers and other members of the crypto community, as well as demanding intellectual property rights to Bitcoin technology.

“First of all, Dr. Wright is not the author of the Bitcoin white paper. Secondly, Wright is not the person who operated under the pseudonym Satoshi Nakamoto between 2008 and 2011. Third, he is not the person who created the Bitcoin system. And, fourthly, Wright is not the author of the initial versions of the software of the first cryptocurrency,” the judge said.

In addition, Mellor suspended two other cases involving “pseudo-Satoshi,” including trials against Coinbase and Block Jack Dorsey.

“This decision is a win for developers, for the entire open source community, and for the truth. For more than eight years, Dr. Wright and his financial backers lied about being Satoshi Nakamoto and used these lies to intimidate developers in the Bitcoin community,” COPA representatives noted.

The judge also plans to sign a restraining order a ruling prohibiting Wright from ever calling himself Satoshi Nakamoto. Lawyers opposed this decision, so the final order has not yet been adopted.

Andorra received recommendations from the IMF on the regulation of cryptocurrencies

The International Monetary Fund (IMF) provided consulting assistance to Andorra on registering and conducting transactions with Bitcoin.

According to the document, in September 2023, the agency conducted a technical assistance mission in the Principality of Andorra with the aim of improving the country’s balance of payments. The country required assistance on 56 topics, one of which was the inability to record cryptocurrency transactions.

“IMF representatives gave recommendations on the accounting of such crypto-assets. Information was provided on how this procedure will change in the next generation of international standards,” the document says.

The Andorran Financial Authority (AFA) informed the IMF that local banks require prior permission to register transactions with bitcoins and other digital assets. The agency added that not a single bank has sent a request for such permission.

As a result, the IMF proposed that the AFA monitor transactions with cryptocurrencies until September 2024. The organization's recommendation for digital asset monitoring was rated medium priority. According to the document, Andorra will be able to use this information to compile its macroeconomic statistics.

The agency said that developing a regional approach to digital money will help mitigate problems such as scalability limitations and economic volatility. However, the IMF warned against the use of unbacked crypto assets as a national currency.