The main thing on the cryptocurrency market.

The inflow of funds in the Bitcoin ETF spot increased to almost $418 million

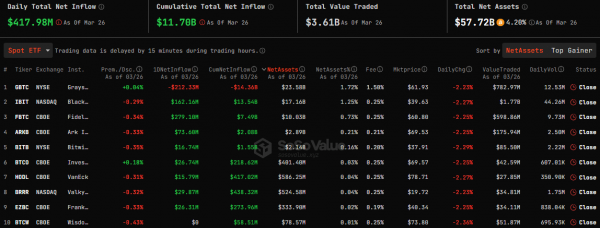

On March 26, 2024, net daily capital inflows into the spot Bitcoin ETF were $417.98 million, according to SoSo Value. Note that the positive trend continues for the second day in a row. On March 25, the inflow of funds amounted to more than $15 million, and outflows were recorded from March 18 to March 22.

According to the data, the first place in terms of capital inflows was taken by the Fidelity Wise Origin (FBTC) crypto fund from the Fidelity company. It added $279.10 million to its balance sheet, and the volume of funds under management reached $7.49 billion.

In second place is iShares Bitcoin Trust (IBIT) with an indicator of $162.16 million, in third – crypto fund ARK 21Shares Bitcoin ETF (ARKB) – $73.60 million. The remaining bitcoin ETFs received a total of $115.45 million.

It should be noted that the spot Bitcoin ETF of the investment firm Grayscale Investments has traditionally been allocated. On March 25, the outflow of funds from the Grayscale Bitcoin Trust (GBTC) amounted to $212.33 million. In total, $14.36 billion have been withdrawn from the fund since the launch of the product.

The outflow of funds from the KuCoin exchange amounted to $882 million amid accusations from the US Department of Justice

The KuCoin cryptocurrency exchange has faced a significant capital outflow, according to the Nansen portal. This comes after federal prosecutors and the US Commodities and Futures Trading Commission (CFTC) brought a number of charges against the company and its founders.

Over the last 24 hours, the total volume of funds withdrawn from exchange accounts exceeded $882 million. The inflow of capital amounted to 99 million. Thus, the net outflow of funds amounted to $783 million. The data covers the Ethereum, BNB Chain, Avalanche, Fantom and Polygon networks.

“Given past incidents, we expect any large-scale regulatory action to result in a sharp outflow of funds. However, for now, the exchange can hold customer deposits and funds in a 1:1 ratio, and remains solvent even under such stress,” said Martin Lee, head of communications at Nansen.

Analysts note that, despite the significant the volume of withdrawn funds, the company has reserves of $5.1 billion. The exchange has 6277 BTC and 99,359 ETH on its balance sheet, according to CryptoQuant. Experts say that the company has a fairly large “margin of safety.”

The movement of funds intensified after US authorities accused KuCoin and its co-founders Chun Gan and Ke Tang of violating the Bank Secrecy Act. The company and entrepreneurs are also suspected of participating in money laundering processes, deceiving investors and unregistered activities.

According to law enforcement officers, during its operation KuCoin received more than $5 billion and transferred over $4 billion in criminal and suspicious funds. The prosecutor's office brought charges against the co-founders of the company, as well as legal entities associated with it, on several counts. Each of them is subject to a term of five to ten years.

The Portuguese regulator will limit the operation of Worldcoin for 90 days.

The National Data Protection Commission of Portugal (CNPD) has decided to temporarily restrict the operation of Worldcoin for a period of 90 days. This was reported by Reuters with a link to the regulator’s report.

According to the statement, the commission intends to prohibit the collection of biometric data by the Worldcoin project through Orb devices. According to the CNPD, this decision was made to “protect the rights of citizens, including minors.” The statement said that the measures taken take effect immediately and until the completion of the investigation, which began on March 8, 2024.

The regulator said that over the past month it has received dozens of complaints about unauthorized data collection using Orb. Residents of Portugal accused the project of “lack of information provided, the inability to erase data or withdraw consent.” The report states that more than 300,000 Portuguese have provided Worldcoin with their biometric data.

Worldcoin Foundation Data Protection Officer Yannick Preivis said that the organization fully complies with all laws and regulations governing the collection and transfer of biometric data.

“Worldcoin respects the role and responsibilities of data protection authorities in Portugal. In the CNPD report, we received information for the first time on many issues, in particular, the message about the registration of minors,” Preivish said.

The London Stock Exchange will begin trading cryptocurrency ETNs in May 2024

On May 28, 2024, the London Stock Exchange (LSE) will begin trading exchange-traded notes (ETNs) on Bitcoin and Ethereum. ETN issuers must prepare the relevant documentation by April 15, 2024, the exchange said in a statement.

The document submitted by the LSE contains a number of requirements for issuers, including preparing a detailed plan and obtaining permission from the Financial Conduct Authority (FCA). ). According to the exchange, trading of cryptocurrency ETNs will be available only to professional investors.

“In choosing the date of May 28, we took into account that it will take time for issuers to comply with the requirements detailed in the newsletter. Cryptocurrency ETNs admitted to trading on the LSE are only suitable for professional traders,” it said.

ETNs are types of unsecured debt securities that track an underlying asset index and are traded on the stock market. Thus, cryptocurrency ETNs will allow investors to trade securities that reflect the performance of crypto assets on the exchange.