The negative effect on the Chinese economy is enhanced by geopolitical factors, primarily the aggressive anti-Western policy of the authorities

The negative effect on the Chinese economy is enhanced by geopolitical factors, primarily the aggressive anti-Western policy of the authorities

China's economy, the second largest in the world, continues to suffer. In a globalized environment with deeply integrated production chains, shocks to such a powerful link are bound to affect others.

We will try to find out how critical the situation is in the Chinese economy and whether this will create problems for Ukraine.

SLOW POST-WATER PROGRESS

China's economy faces many challenges in the post-Covid period. Exports and domestic consumption, which were the main drivers of its growth in the pre-pandemic years, remain unstable and weak, unable to ensure the desired pace of recovery.

Added to this is a large-scale crisis in China’s real estate sector, overloaded with billions of dollars in debt, which cannot recover on its own, and the state is in no hurry to lend a helping hand. The problems of Chinese developers began with the fall of the largest developer Evergrande Group, whose debt burden reaches $300 billion, and which declared default back in 2021, and this year filed for bankruptcy in the United States.

The second-largest local developer, Country Garden, lost $7.1 billion in the first half of this year and defaulted on debt in October. Most large Chinese developers are in a similar state of crisis, whose capitalization has fallen significantly since 2019. Liquidity crises in the real estate sector regularly crash the local stock market, distracting investors and making Chinese and foreign businesses nervous.

The negative effect on the Chinese economy is enhanced by geopolitical factors, primarily the aggressive anti-Western policy of the current Chinese government and the acceleration of the course towards the formation of its own competitive Western bloc of countries to change this world order. Beijing’s friendship with Russia, Iran and Syria does not go unnoticed by Europe, North America and the capitals of democratic countries around the world, encouraging them to act proactively and reduce the risks of cooperation with China. In practice, this means a gradual reorientation towards doing business with friendly countries and a reduction in investment and trade in China.

The above factors, together with the government's ongoing efforts to impose a stranglehold of state control on all business processes in the country, demotivate both local and foreign entrepreneurs and repel investors, which ultimately affects the pace of recovery of the national economy. Western analysts warn of high risks of a prolonged slowdown in China's economy and recession, while Beijing acknowledges the problems but argues that there will be no critical consequences.

Officials in Beijing attribute the slow pace of renewal to a qualitative overhaul of the economy. They say that previously the main goal was high growth rates of gross domestic product (GDP), which resulted in imbalances in sectors and excess production capacity.

Now the goal is balanced growth, that is, attention primarily to high-quality development, modern technologies with artificial intelligence (AI) and green energy. And such a transition, naturally, will affect current economic indicators, but in the medium and long term its positive effect cannot be overestimated.

OPTIMISTIC GOVERNMENT STATISTICS

In their forecasts, experts use monthly and quarterly data from the State Statistical Office of the People's Republic of China, and they do not indicate an alarming economic situation; on the contrary, they demonstrate, although restrained and unstable, tireless movement forward. Thus, after the lifting of pandemic restrictions at the beginning of this year, an optimistic return to pre-Covid indicators was recorded: according to the State Statistics Service, China’s economy grew by 4.5% in the first quarter compared to the previous year, which exceeded analysts’ forecasts, which gave only 4%.

At the same time, already in the second quarter, GDP growth rates turned out to be lower than experts’ expectations and amounted to 6.3%, while the consensus forecast of experts suggested an increase of 6.9–7.3%.

In the third quarter, China's economy grew 5.2% year on year and, like in the first quarter, exceeded analysts' forecasts by 0.2%. Optimistic data allowed the Chinese government to announce good macroeconomic indicators for the next period, and the International Monetary Fund (IMF) to revise its forecast for China's GDP growth upward to 5.4% from the previous 5%.

The attention of economic analysts was drawn to the November data recently released by the State Statistics Service of China, which remains weak, but already contains certain indicators that are optimistic for the country. In particular, the monthly composite average PMI (Purchasing Managers Index), which characterizes the state of the business climate in the country, increased for the first time in seven months and reached 51 (a figure of more than 50 indicates a revival of economic activity). This is lower than the pre-pandemic and 2019 average of 52.5, but suggests positive signs for the Chinese economy.

In November, also for the first time since April, China's exports increased compared to the same month last year. And although we are talking about only 0.5%, this is more than analysts' forecasts, which expected growth of 0.4%, and also contrasts sharply with a fall of 6.4% in October compared to October last year. So there are some positive signs.

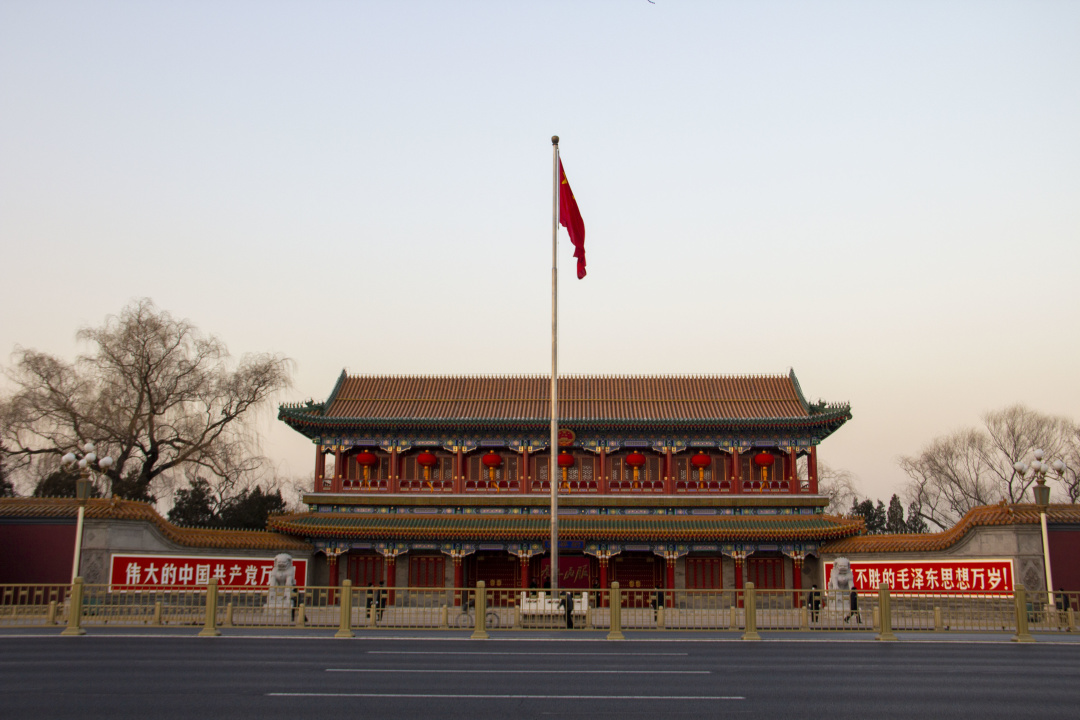

Photo: DPA

Photo: DPA

The remaining key indicators are not encouraging for Beijing. In particular, there are no signs of a revival in domestic consumption, which would provoke deflation. Consumer inflation is plunging deeper into deflation territory, as indicated by the Consumer Price Index (CPI), which fell 0.5% year-on-year in November, the most since November 2020, and well above the 0.2% decline in October. %. .

The decline in the Chinese producer price index (PPI), which reflects the cost of enterprise products for wholesale buyers, has also accelerated and has fallen for the 14th month in a row. In November, PPI fell 3% year on year, compared with a 2.6% fall in October. On a monthly basis, PPI decreased by 0.3%, remaining unchanged in October.

Core inflation last month was unchanged from October and remained at 0.6%. Analysts believe low inflation reflects lower selling prices by manufacturers trying to protect their share of domestic and export markets amid falling global demand for goods following the coronavirus pandemic and due to negative developments.

Great concern among experts has led to increased mistrust of the Chinese economy on the part of foreign investors. The latest data from China's Ministry of Commerce showed that in the first 10 months of the year, despite an increase in the number of newly established foreign-invested enterprises, actual foreign capital employed in yuan fell by 9.4%, or $11.8 billion, year-on-year to 987 billion yuan ($138 billion). This is the first quarterly deficit since 1998, which recorded an excess of capital outflows over investment inflows into China.

In addition, foreign investors have been selling Chinese stocks for four months, marking the longest selling streak. So far we are talking about the sale of securities by foreigners for 1.8 billion yuan ($252 million) in net terms, which is not too critical. However, the Chinese stock index continues to fall and its future does not look very attractive.

SLOW CHINA AND THE WORLD

This is the situation in China, but how much can it affect the economic stability of other countries and, above all, Ukraine? The Chinese government says China remains the biggest engine of global economic growth and could account for a third of that growth this year. The figure is more than decent.

However, according to some Western economists, China's role as an engine of global prosperity should be assessed with caution. Mathematically, yes, China accounts for about 30% of global economic growth, but such growth is beneficial only to this country with its export-oriented economy.

Western analysts point out that China has a large foreign trade surplus and exports far more than it imports, so how much its economy grows or doesn't grow is really more about China itself than the rest of the world. Given this, the slowdown of the Chinese economy will have a limited impact on countries and will create the most problems for those that are too closely linked in production chains with the Middle Kingdom.

Photo: bloomberg

Photo: bloomberg

Thus, lower spending in China on goods and services or real estate construction will mean less demand for raw materials and goods, and therefore will affect such large resource exporters to China as Australia, Brazil and several African countries. At the same time, weak demand in China also means prices there will remain low, which is good news for countries struggling with high inflation and could even benefit ordinary consumers in the short term.

In Europe, the biggest losers from China's slowdown could be Germany, the world's fourth-largest economy with extremely close manufacturing ties to the Middle Kingdom in auto manufacturing, chemicals and other industrial sectors. The turmoil of the German economy, the locomotive of the European economy, will, of course, have an impact on other EU countries, but will such an impact be critical?

Last year, when Europeans sharply reduced imports or abandoned Russian oil and gas after Russia's attack on Ukraine, showed the sufficient stability of the economies of European countries and the professionalism of their governments in seeking diversification. This is despite the fact that Russia was a monopoly supplier of critical raw materials, while China does not have such status. So the negative consequences are inevitable, but the EU countries can easily cope with them.

The situation is similar with Ukraine. Before the outbreak of the Great War, China remained Ukraine's largest trading partner with rapidly growing trade turnover. In 2021, according to the domestic State Customs Service, trade between Ukraine and China reached a record high of almost $19 billion, jumping by a third compared to the previous year.

At the same time, the basis of Ukrainian exports to China is agricultural products, the production of which does not depend too much on connections with the “factory of the world”, and replacement for which is difficult to find. Therefore, China will most likely continue to buy Ukrainian agricultural products, but European and other partner countries will help Ukrainians compensate for the decrease in imports of Chinese industrial goods, if such a need arises.

So, to summarize, we can say that the apocalyptic forecasts for the Chinese economy are not entirely fair, as are the overly optimistic reports of the local government. Serious challenges to its future remain and require urgent solutions. Recipes for overcoming difficulties are generally known, but are not suitable for the Chinese authorities, since they require less government intervention and more freedom for business, which contradicts Beijing’s general course of establishing total control over all life in the country.

The Chinese government uses its own tools, administrative methods and incentive measures that would not be accepted in Western societies, but work in the PRC. The effectiveness of the government’s steps can be seen in the fact that the above problematic factors did not lead to a sharp deterioration in the lives of ordinary Chinese, protests or rallies of those who are dissatisfied with the actions of the authorities.

Most of them are not too concerned about the problems of the real estate market that are remote for the average citizen or low domestic consumption. These phenomena have not greatly affected their lives, at least not yet.

Indeed, trained by the bitter experience of long-term lockdowns, residents of the Middle Kingdom are now in no hurry to spend their earnings on expensive purchases, but after the lifting of restrictions they are again actively traveling around the country and abroad, spending money on leisure and recreation. They also don’t really rely on help from the authorities and independently look for opportunities to develop their business and earn more.

Vladimir Sidorenko, Beijing