The National Bank sharply worsened the forecast for Ukraine's trade deficit. This is stated in the presentation for the latest NBU briefing on monetary policy.

► Read the Ministry of Finance on Instagram: the main news about investments and finance< /p>

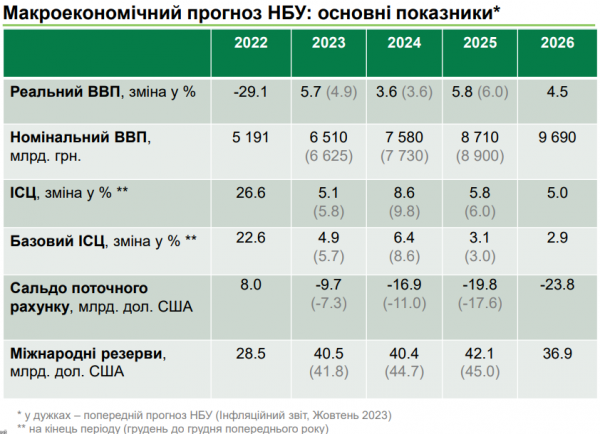

In 2024, the negative current account balance is expected to increase by 74% – from $9.7 billion to $16.9 billion (in October, an increase of 50% was predicted from $7.3 billion to $11 billion), and in 2025 year – by another 17% to $19.8 billion (previously – by 60% to $17.6 billion).

International reserves at the end of 2024 are forecast at $40.4 billion (in the previous forecast – $44 .7 billion), at the end of 2025 – $42.1 billion (in the previous forecast – $45 billion).

The current account is the main component of the consolidated balance of payments, which shows the ratio of payments abroad and receipts of money from abroad.

The current account includes the results of trade in goods and services, payment of dividends and direct payments (for example, transfers from employees). If the current account balance is negative, this indicates an outflow of currency from the country.

Another component of the balance of payments is the capital account, which includes foreign direct investment, debt obligations and trade credits.

If income from the capital account is not enough, the difference will have to be covered from international reserves. Another option is a weakening of the hryvnia, which will lead to an increase in the cost of imports and a decrease in demand for them.