Shares of Meta and Amazon soared by 272 billion after the publication of financial reports. Giant companies reported higher-than-expected profits. Bloomberg writes about this.

► Subscribe to the Ministry of Finance telegram channel: main financial news

Market reaction to reports

Meta reported an increase in advertising revenue, and Amazon reported an increase in online sales. Both companies made large-scale staff reductions, which had a positive impact on their overall financial situation.

Meta Platforms:

Earnings per share: $5.33 (est. $4.97)

Revenues: $40.11 billion (est. $39.20 billion )

Amazon:

Earnings per share: $1.00 (expected $0.78)

Revenues: $169.96 billion (expected $166.21 billion)

Immediately after the publication of reports, shares of these companies took off in the premarket. Here's what the charts look like at the time of writing this news:

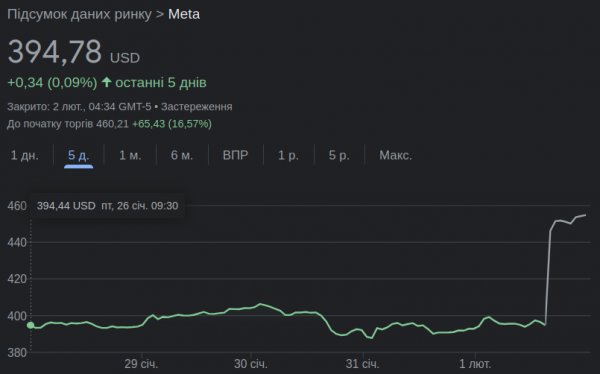

Change in Meta stock price over 5 days/Source: Google

As the graph shows, the market closed at $394.78, but after that, in the premarket, the price soared to $454.85.

Share price change Amazon for 5 days/Source: Google

The Amazon chart shows a similar situation – closing price $159.28, premarket – $170.60.

Reduction

Business restructuring, including staff reductions, had a major impact on revenue growth overall.

Meta reduced its headcount by 22% in 2023, and Amazon laid off about 35 thousand people last year .