The main thing on the cryptocurrency market.

The volume of liquidations on the crypto market exceeded $356 million

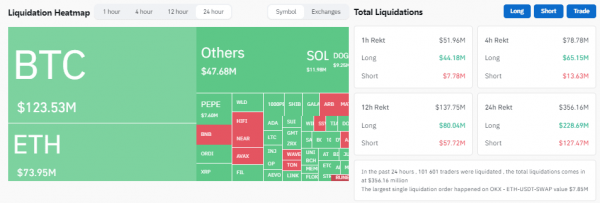

In the period from March 12 to March 13, 2024, the volume of liquidations on futures contracts on the crypto market amounted to $356.16 million. This is evidenced by CoinGlass data. The indicator was influenced by the growth of Bitcoin and the update of Dencun in the Ethereum network.

Most of the losses occurred in pairs with Bitcoin – $123.53 million. In second place is Ethereum – $73.95 million.

101,601 traders were liquidated. Long positions accounted for more losses – $228.61 million.

The anti-leaders behind crypto exchanges were once again OKX and Binance. They account for $159.06 million and $116.95 million, respectively.

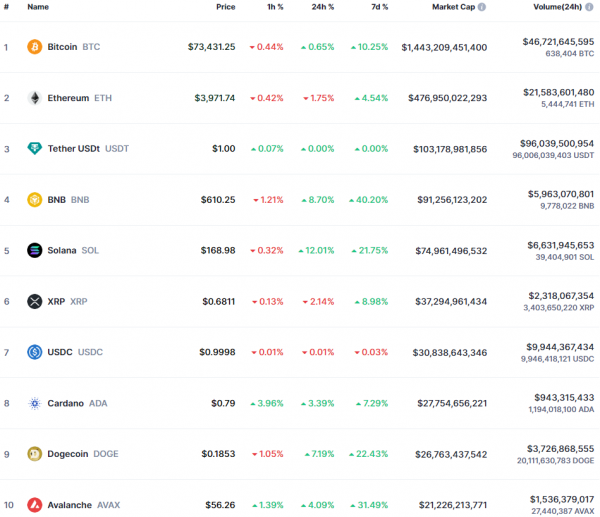

At the time of writing the news, the price of Bitcoin is about $73,430, Ethereum – $3,970.

Mike Novogratz predicted the growth of Bitcoin up to $100,000

Quotes of the first cryptocurrency are unlikely to fall below the $50,000 level unless “something dramatic” happens. This was stated by the head of the investment company Galaxy Digital, Mike Novogratz, in an interview with CNBC.

He explained the growth of Bitcoin by the continuous influx of funds in the Bitcoin ETF spot. Until it stops, the rally of the first cryptocurrency will continue.

“As soon as the indicator turns negative, you will see the first real correction. Funding rates are high, and during such periods you should always be prepared for adjustments. I don’t think we will return below $50,000-55,000,” Novogratz said.

According to him, after the approval of the Bitcoin ETF, there was a “shift of thinking” in the market. Baby boomers (those born between 1946 and 1964) got their first chance at digital gold because of registered investment advisors, he noted.

Bitcoin owners, however, do not like to sell the first cryptocurrency and often evaluate their capital in terms of the number of BTC, and not US dollars in the wallet, Novogratz emphasized.

According to the expert, digital gold could reach $100,000. He also doubted that all spot Bitcoin ETFs will ever accumulate more than 20% of the asset's supply.

“They are loading now. At some point, the situation will reach balance. There are many people who still want to store their BTC themselves or keep it with a foreign custodian if they don’t trust the country they are in,” Novogratz explained.

Dogecoin rose amid Musk’s announcement about payments Tesla

Elon Musk suggested that in the future Tesla will begin to accept Dogecoin as a means of payment for cars. The American billionaire made the following statement during a recent visit to the Giga Berlin plant.

“When will you be able to buy a Tesla with Dogecoin? At some point, I think we should implement this. So, Dogecoin is going to the moon,” said Elon Musk.

In January 2022, Musk added a Dogecoin purchase option to the Tesla website. However, some souvenirs and chargers can be paid for with cryptocurrency.

Amid this announcement, Dogecoin jumped to levels above $0.19. At the time of writing, Dogecoin is trading around $0.186. The asset grew by 7.19% in one day, and by 22.43% in a week.

At the same time, the memcoin rate is still far from its historical maximum. According to CoinMarketCap, the price of Dogecoin reached $0.73 in May 2021. Currently, the cryptocurrency ranks 9th in terms of capitalization with $26.7 billion.

Binance will delist several trading pairs with the TUSD stablecoin

The Binance cryptocurrency exchange announced that tomorrow, March 15, it will delist several trading pairs with the TUSD stablecoin and the BNB coin, namely:

- ARPA /BNB, COMP/TUSD, EDU/BNB, EDU/TUSD, PENDLE/TUSD.

“To protect users and maintain the high quality of the trading market, Binance conducts periodic reviews of all spot trading pairs and may delist individual pairs due to a variety of factors, such as low liquidity and trading volume,” it states. statement.

The company noted that delisting does not affect the availability of assets on the spot market. The message states that users can still trade tokens on other pairs available on the exchange.

Recall that on the night of January 15-16, 2024, the TUSD stablecoin lost its peg to the dollar, the asset reached $0.97 . At the time of writing the news, it is trading at $1.