The International Monetary Fund has updated the base and negative scenario for Ukraine. The negative scenario assumes that, due to the increasing intensity of the war, the shock to the economy will begin as early as the second quarter of this year. This is stated in the updated Memorandum on the IMF.

► Read telegram channel “Ministry of Finance”: main financial news

“In line with the IMF's policy of lending under exceptionally high uncertainty, staff have updated the downside scenario based on the assumption that war will be more intense in 2025,” the document notes.

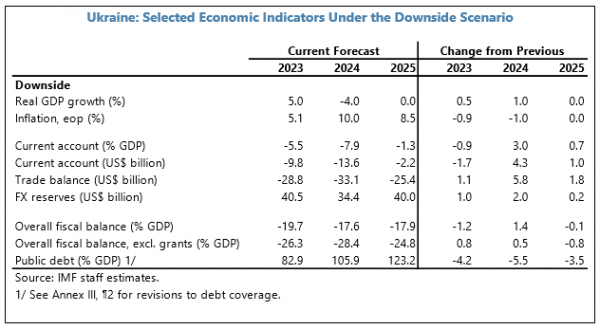

Downside scenario

The negative scenario assumes that the war will end by the end of 2025, compared to the end of 2024 in the base scenario. It is noted that the shock will begin in the second quarter of 2024 due to the intensity of the war.

This will lead to a sharp decline in real GDP by 4% in 2024 (compared to growth of 3-4% in the baseline scenario) and zero growth in 2025.

At the same time, the IMF expects a decline in the economy with a negative The scenarios have improved compared to the forecast in December 2023, when the Fund expected a fall in GDP of 5%.

The increase in inflation in 2024 is expected to be 10%, in 2025 – 8.5%.

The total financing gap in the negative scenario is estimated at about $140.6 billion, which is about $19 billion more than in the baseline forecast for 2023-2027 ($121.8 billion).

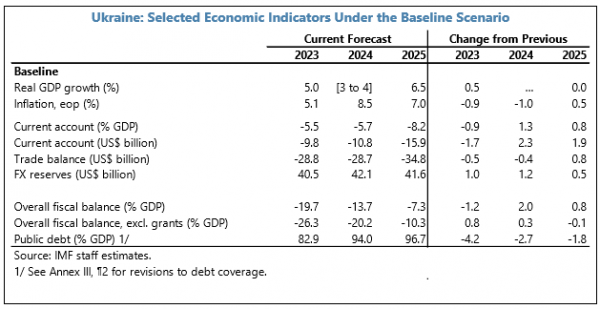

Baseline scenario

The International Monetary Fund's baseline scenario has not changed significantly and assumes lower inflation.

Impact on the Ukrainian economy

According to the IMF’s negative scenario, the intensification of the war will affect household sentiment, the rate of return of migrants and lead to damage to infrastructure as a result of the attacks.

Given continued high defense needs and declining economic activity, the budget deficit will continue to widen in 2024-2025 and then improve only gradually, it said.

“Foreign exchange market imbalances will resurface and are expected to persist longer given worsening export performance, leading to higher nominal depreciation in the coming years before it moves closer to the underlying trend,” the IMF predicts.