The main thing in the cryptocurrency market.

Bitcoin and Ethereum Post Worst First Quarter in Seven Years

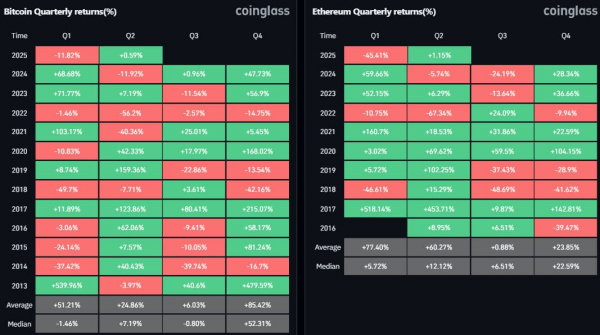

Bitcoin and Ethereum ended the first quarter of 2025 with a significant decline, with asset prices down 11.82% and 45.41%, respectively, according to data from CoinGlass. This is the worst first quarter for both cryptocurrencies in the last seven years, Incrypted reports.

The first three months of the year have been positive for both assets over the past two years. In 2023 and 2024, Bitcoin grew by 71.77% and 68.68%, respectively, while Ethereum rose by 52.15% and 59.66%, respectively.

The first quarter has always been a period of uncertainty for the first cryptocurrency. Over the past 13 years, Bitcoin has ended the period in the “red zone” seven times, six times with positive indicators. For Ethereum, the first three months of the new year are a period of growth, the asset has closed the quarter in the green zone six times out of nine.

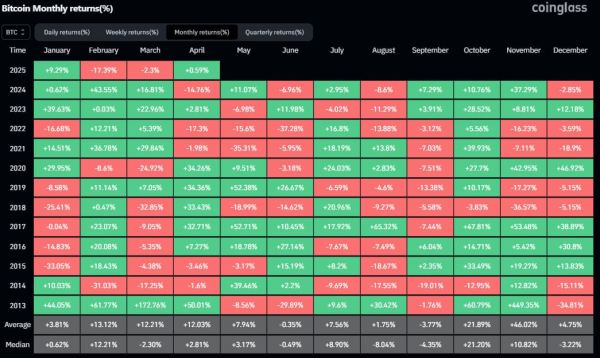

As for the asset indicators for March 2025. The monthly decline in the Bitcoin rate was 2.3%, this is the first negative indicator for the first cryptocurrency since 2021.

Ethereum's price fell by 18.69% in March, which is also the worst performance for the asset in the last four years. From 2021 to 2024, the coin showed only growth. In total, since its existence, the asset has closed March in the “red zone” only three times.

Crypto funds see inflows into altcoins for the first time in five weeks

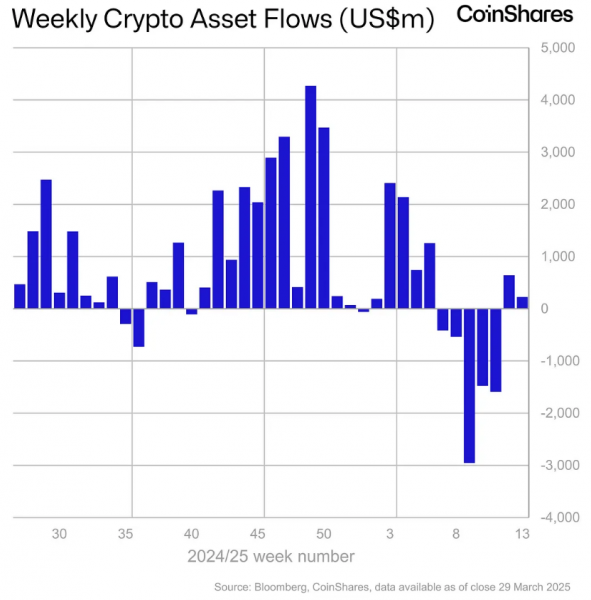

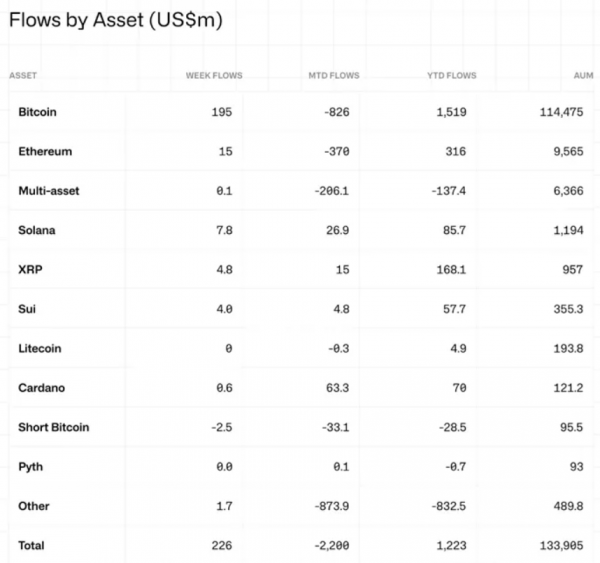

From March 22 to March 28, the volume of inflows into crypto investment funds slowed from $644 million to $226 million, including altcoins ($33 million), according to CoinShares data.

Over the past four weeks, investors have withdrawn a total of $1.7 billion from altcoins.

The main beneficiaries of inflows in the previous reporting period were:

- Ethereum — $14.5 million; Solana — $7.8 million; XRP — $4.8 million; Sui — $4 million.

In instruments based on the first cryptocurrency, the inflow decreased from $724 million to $195 million.

In the US spot bitcoin ETF segment, investors added $196.5 million to the products. The positive dynamics lasted for the second week in a row.

From structures that allow shorting digital gold, clients withdrew $2.5 million (previously $3.6 million).

Initia to Give Away 50 Million INIT Tokens Before Mainnet Launch

Blockchain project Initia has announced an airdrop of 50 million INIT tokens ahead of the launch of its mainnet.

The distribution of tokens will occur as follows:

- 90% of the supply (approximately 44.7 million INIT) will be allocated to users who performed activities in the Initia testnet in 2024. A total of 194,294 users joined the campaign and performed interactive blockchain tasks, in particular, raising a virtual pet named Jennie; 4.5% (which is about 2.25 million INIT) will go to active users of Initia's partner networks – LayerZero, IBC and MilkyWay; 6% (about 3 million INIT) will go to social media participants who actively interacted with Initia on Discord, Telegram and X.

Internal participants (team and investors) will not participate in the airdrop.

Other users can check the wallet for eligibility on the official Initia website, and tokens can be claimed within 30 days of the mainnet launch.

Dollar May Cede Reserve Currency Status to Bitcoin — BlackRock

If the US government does not get its national debt under control, the dollar will lose its status as the world's reserve currency, BlackRock CEO Larry Fink said in his annual letter to investors.

Fink noted that the “U.S. debt clock started ticking” in 1989. By 2030, however, debt servicing will consume all revenue, he stressed, leading to a permanent deficit.

“If the US does not get its debt under control and if the deficit continues to grow, America risks losing ground to digital assets like Bitcoin,” the letter says.

Fink stressed that he is not opposed to crypto assets. In fact, he considers them an unusual innovation. At the same time, digital assets could undermine the economic dominance of the United States if investors start to view bitcoin as a safer alternative to the dollar, he believes.

The head of BlackRock also compared the SWIFT system to the outdated postal service. At the same time, tokenization, in his opinion, is an e-mail.

Choose favorable rates and reliable services for cryptocurrency exchange with “Minfin”

🕵️ We created a short survey to learn more about our readers.

💛💙 Your answers will help us become better, pay more attention to the topics that interest you.

🤗 We would be grateful if you could take a minute to answer our questions.

- Cryptocurrency