Ukrainians have been reminded of the need to pay taxes on any money transfers received on bank cards. The only exceptions are official salaries, scholarships, pensions and other state payments. The State Tax Service provided the relevant information, commenting on citizens' appeals, writes IZ with reference to Telegraph.

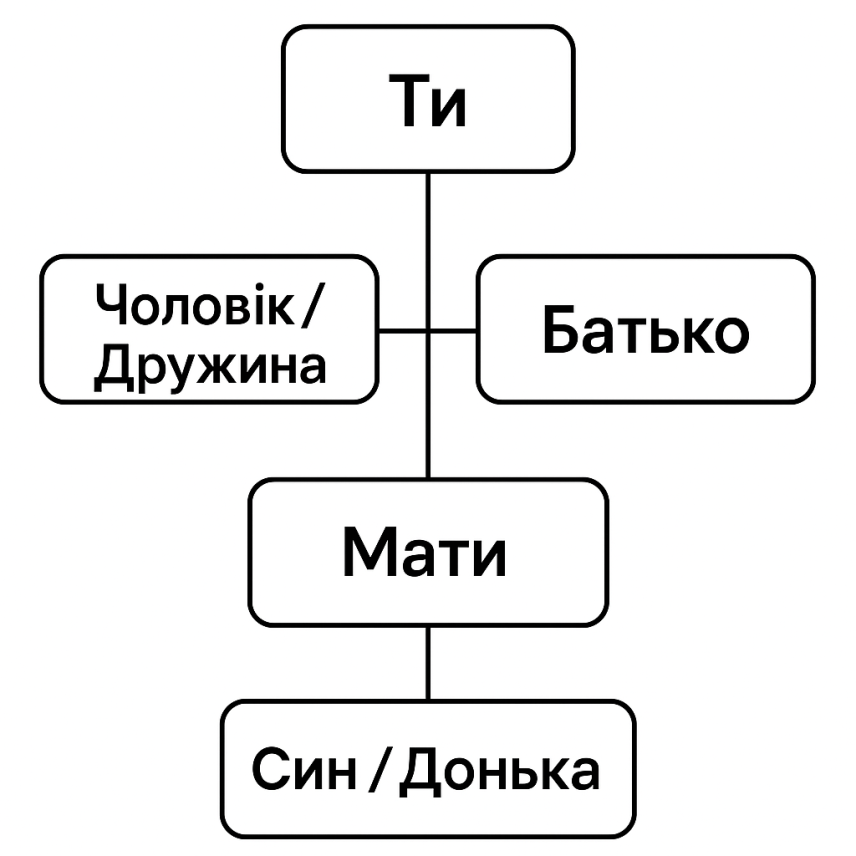

The tax office noted that even one hryvnia transfer from another individual is considered income that must be declared and taxed. This also applies to transfers from relatives, friends, or acquaintances. In the case of receiving funds from family members of the first degree of kinship without taxation, an obligatory condition is to indicate that it is a gift or inheritance.

Scheme of relatives of the 1st degree of kinship according to the Tax Code

Scheme of relatives of the 1st degree of kinship according to the Tax Code

” A natural person who, during a calendar year, receives income for the provision of services from another natural person is obliged to include the amount of such income in the general annual income tax and submit an annual tax return ,” the tax service explained.

From the income received on a personal card, it is necessary to pay personal income tax (18%) and military levy. The amount of military levy is changing: for 2024 – 1.5%, and from 2025 – 5%. Taxes must be paid independently after submitting an annual declaration. The deadline for submitting a declaration for the previous year is May 1, and tax payment is August 1.

Payments can be made online through the taxpayer's electronic account or through banking institutions. Payment details are provided after registering the declaration. The tax office also reminded of the responsibility for violating the payment deadlines: a fine of 3% of the debt amount and a penalty for each day of delay is imposed.

Cashback and interest on deposits are also subject to taxation. For example, Monobank users automatically pay 23% tax when withdrawing cashback to a card — 18% personal income tax and 5% military duty. At the same time, national cashback, as compensation for expenses, is not considered income and is not taxable.

Pensions, scholarships, and social benefits, like salaries, do not require additional declaration or payment of taxes, as these amounts are taxable or exempt from tax by law.

If the taxpayer has not previously declared such income, he has the right to file a clarification declaration and pay taxes voluntarily. In this case, only minimal sanctions may be applied. Tax authorities recommend consulting with specialists to properly prepare documents and avoid violations.

We remind you that we previously wrote about how the dollar and euro exchange rates changed after the introduction of global trade tariffs.