Photo: The war could last longer, the IMF believes (Getty Images) Author: Alexander Belous

Experts from the International Monetary Fund have updated the negative scenario for Ukraine in case of a more intense war. In this case, the economy will fall in 2025 and 2026.

This was reported by RBC-Ukraine with reference to the Memorandum with the IMF.

The scenario assumes that the war will last until mid-2026, with the deterioration shock beginning in the second quarter of 2025.

“This shock would put strong pressure on corporate and household sentiment and the pace of migrant returns, and would result in further large-scale damage to energy infrastructure and power outages compared to the baseline scenario,” the Memorandum says.

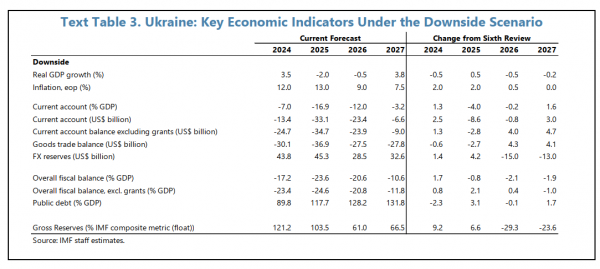

The revised scenario projects a 2% decline in real GDP in 2025 and a 0.5% decline in 2026. Even fewer refugees will return in the post-war period than in the baseline scenario, slowing growth in 2027 to 3.8%.

The total financing gap in the negative scenario is estimated at $162.9 billion, which is $14.1 billion higher than the baseline forecast ($148.8 billion). This amount is calculated for the entire duration of the IMF program (Q2 2023 – Q1 2027).

The reduction in external economic and military support could over time undermine an already difficult security situation, leading to weaker economic performance and open funding gaps, the document says.

“Reform fatigue and problems of political consensus are vulnerabilities regardless of the development of the war,” the IMF notes.

The negative scenario assumes that the imbalance in the foreign exchange market will re-emerge and persist for a longer period, given the worse export performance.

Possible reaction of the Ukrainian authorities

The IMF notes that since the start of the war, authorities have taken steps to respond decisively to shocks as they occur, carefully balancing the need for a rapid and effective response with social considerations.

These measures included tax changes, streamlining capital expenditure and other lower-priority spending items, seeking additional financing, and implementing decisive measures to maintain financial stability and protect international reserves, including through currency controls.

The IMF believes that contingency plans will require increased tax revenues, seeking additional external financing on very favorable terms, tightening monetary policy, mobilizing domestic financing, and likely further adjustments to foreign exchange policy.

The increase in VAT and the acceleration of excise tax convergence with the EU could be implemented effectively and quickly to raise revenue, while capital and social spending could be limited to only the highest priority categories, the review says.

“The authorities’ very strong political commitment and track record, together with renewed financing guarantees from international partners and expected debt relief, provide confidence that even in this updated downside scenario, the program’s objectives… can be achieved,” the Memorandum says.

Let us recall that the IMF updated its baseline scenario, according to which Russia's war against Ukraine will end at the end of 2025. This scenario assumes that Ukraine's economy will grow by 2-3% in 2025 and accelerate to 4.5% in 2026.