The total value of Chinese stocks has fallen by $6.3 trillion since 2021. The beginning of 2024 for this market also turned out to be unsuccessful, for example, the Hong Kong index (HSCE) has already lost 11%. Bloomberg writes about this.

► Subscribe to the Ministry of Finance telegram channel: main financial news

Shanghai Stock Index (SSE Composite) since the beginning of the year it has lost 4.39%, and within 6 months the fall has been more than 10%.

The reasons are the general gloomy situation in the economy of this country. China was unable to recover quickly from the coronavirus pandemic, although GDP growth of 5% over the past year even exceeded the government's hopes.

However, the global real estate crisis and the negative geopolitical background do not allow China to return to growth. In addition, investors choose their competitor India, which demonstrates the best performance in the world in terms of economic and stock market growth.

As Bloomberg notes, the prolonged collapse of Chinese stocks is also having a negative impact on the economy, wreaking havoc in the area of asset management.

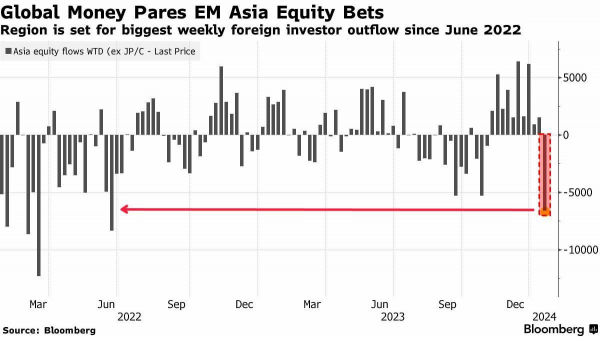

Outflow from Asian stocks has reached the highest since June 2022

< ul class="news-chips">