In the first quarter of 2024, banks expect a reduction in rates for businesses and households, with stable volumes of customer funds. This is evidenced by the results of a quarterly survey of banks on funding conditions, reports the NBU press service.

► Subscribe to the Telegram channel “Ministry of Finance “: main financial news

Volumes of banks' liabilities

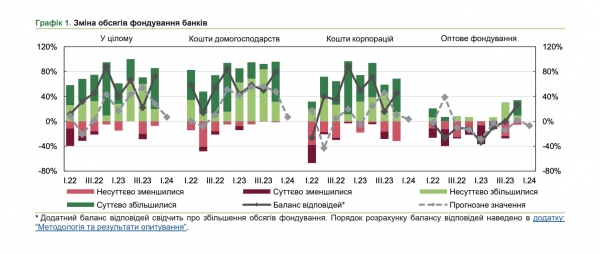

It is noted that the volumes of banks' liabilities increased during the fourth quarter mainly due to the attraction of funds from households and corporations.

At the same time, for the first time in two and a half years, the volumes of wholesale funding (bonds, loans from international financial organizations or parent banks, long-term refinancing, etc.) slightly increased in some large banks.

More active attraction of household funds by banks was primarily facilitated by regulatory requirements. Attractions from businesses grew mainly due to suggestions from customers themselves. At the same time, the influence of the level of interest rates, which throughout 2023 was the determining factor in the growth of customer deposits, has significantly decreased.

According to the results of the current survey, wholesale funding was planned to be attracted mainly by large banks and was expected to do this already in the first quarter .

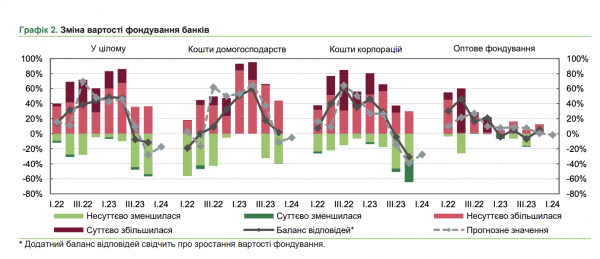

About two-thirds of respondents reported a decrease in the cost of business funds during the quarter, while at the same time the price of household deposits and wholesale borrowings did not change significantly.

Further reduction in the cost of corporate funds in the first quarter expected by 69% of respondents, public funds – 50%. The price of wholesale funding, according to banks' forecasts, will not change.

The share of funding in foreign currency decreased in 2023. More than half of those surveyed expect this trend to continue in the first quarter.

Funding maturity decreased slightly in the fourth quarter, but banks do not expect any changes in the next 12 months.

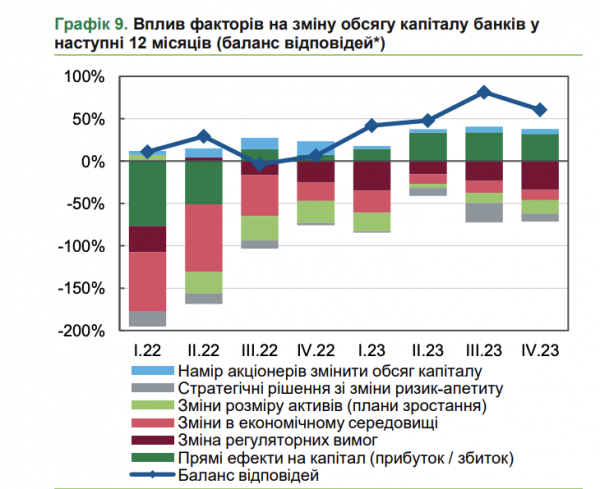

For the first time in almost two and a half years half of respondents reported a decrease in the cost of capital. Banks expect a further decrease in the cost of capital.

Survey methodology

The survey on bank funding was conducted from December 15, 2023 to January 12, 2024 among bank managers responsible for liability management. Answers were given by 26 financial institutions, their share in the total assets of the banking system is 96%.

The survey results reflect the opinions of respondents and are not estimates or forecasts of the National Bank.

- Deposit