As appropriate prerequisites are formed, the NBU will gradually allow greater exchange rate fluctuations in accordance with changes in market conditions. This is stated in the Inflation Report of the National Bank for January 2024.

► Read telegram channel < i>“Ministry of Finance”: main financial news

The regulator noted that increasing exchange rate flexibility is a necessary step to restore its role as a means of adapting the economy to external and internal shocks.

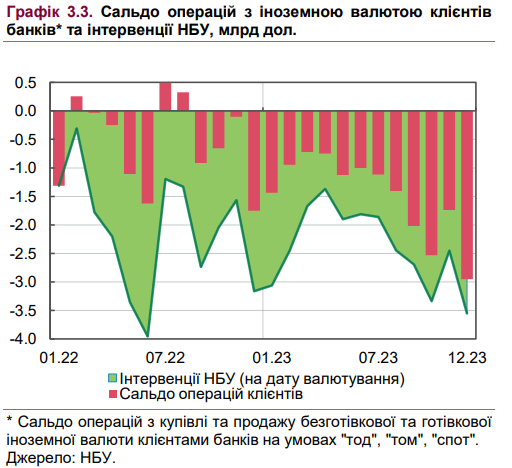

After transition to the managed flexibility mode, the volume of bank operations without the participation of the NBU significantly increased. This indicates an increase in the depth of the interbank foreign exchange market, and, accordingly, an increase in its resistance to situational factors.

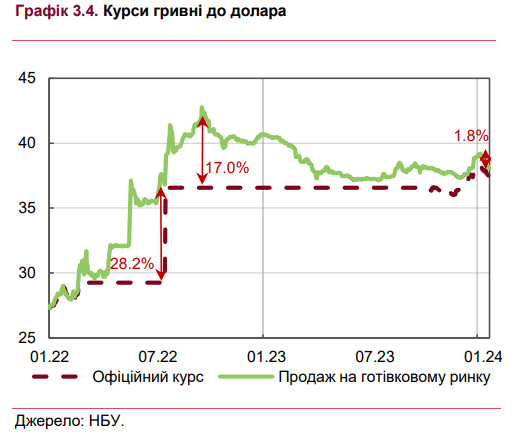

“The connection between the cash and non-cash segments of the foreign exchange market has also strengthened. With the exception of the last days of the year, the difference between cash and official rates decreased, in particular due to the lifting in December of restrictions for banks and non-bank financial institutions on the sale of cash foreign currency to the public,” the report says.

At the same time, despite the transition to a managed flexibility regime, ensuring exchange rate stability remains the NBU’s main means of achieving inflation goals and maintaining macro-financial stability.

“The NBU maintains its presence in the foreign exchange market and compensates for the structural deficit on it, allowing the exchange rate to fluctuate in both directions under the influence of situational changes in demand and supply of currency,” the regulator emphasized.

The situation on the foreign exchange market in the fourth quarter of 2023 and the beginning of 2024

In October – the first half of November 2023, the ratio of supply and demand in the foreign exchange market improved. This was largely due to the effect of the blockade of individual checkpoints on the western border of Ukraine, which had a greater impact on imports than on exports.

At the same time, export earnings even slightly increased due to the increased capacity of the new sea route and the Danube ports. As a result, the NBU's interventions on the sale of foreign currency decreased, and the hryvnia exchange rate strengthened.

At the same time, from the second half of November, the net demand for foreign currency increased again. This was due to both seasonal factors and the objective consequences of the war.

Thus, the demand for imported food products, intermediate consumer goods for farmers, fuel and certain products of mechanical engineering and the pharmaceutical industry increased.

In addition, increased uncertainty in the receipt of official funding and record budget expenditures led to increased demand for foreign currency.

Under such conditions, the NBU in December significantly increased interventions on the sale of foreign currency (up to $3.6 billion), and the exchange rate The hryvnia weakened by 2.6% on average compared to November. The negative balance of NBU interventions for the quarter as a whole increased to $9.3 billion (compared to $7 billion in the third quarter).

“Sufficient volumes of interventions and NBU measures to maintain the attractiveness of hryvnia instruments ensured controllability of the foreign exchange market. As a result, in the fourth quarter, the hryvnia exchange rate on average remained almost unchanged compared to the previous quarter,” the report says.

Remember

On October 3, the National Bank introduced a regime of managed exchange rate flexibility. Before this, from the beginning of the war, the NBU kept a fixed exchange rate of the hryvnia to the dollar – first 29.25 UAH/$, and from July 21, 2022 – 36.57 UAH/$.

After this, the official dollar exchange rate fell to 36 .03 UAH/$. Then, by the end of December 2023, it rose to 37.98 UAH/$.

At the beginning of January 2024, the official dollar exchange rate reached 38.22 UAH/$. However, then he rolled back. As of February 2, it is 37.60 UAH/$.