The main thing on the cryptocurrency market.

Nigerian authorities demand $10 billion compensation from Binance – BBC

The Nigerian government has asked the Binance cryptocurrency exchange for damages in the amount of $10 billion for manipulating the naira exchange rate. The BBC reports this.

According to the authorities, the trading platform influenced the growth of foreign currencies within the country through speculation in the Naira exchange rate. This has led to a drop in the naira by almost 70% over the past few months.

Adviser to the President of Nigeria Bayo Onanuga clarified that the government saw a negative effect from the transactions of the largest exchange in terms of trading volume.

“On The Binance platform employs people who fix the exchange rate (naira, -ed.), which is rapidly affecting the Nigerian economy at a time when the country is trying to stabilize it,” he said.

Onanuga also added that Binance and other cryptocurrency exchanges are not registered in accordance with Nigerian laws.

“We are demanding about $10 billion in compensation for the damage that has almost destroyed our economy in a very short time,” said Onanuga. Advisor to the President of Nigeria.

Eight states accused the SEC of exceeding its powers with a lawsuit against Kraken

The attorneys general of eight states filed a joint statement in court, in which they accused the US Securities and Exchange Commission (SEC) of exceeding its powers for suing the Kraken platform.

The attorneys general of Iowa, Arkansas, Mississippi, Montana, etc. joined the appeal. Nebraska, Ohio, South Dakota and Texas, as well as several other politicians and industry experts.

In the statement, officials emphasized that they do not support either side. However, they expressed concern about the actions of the SEC, which were not delegated to the regulator by the US Congress.

“The Commission's actions put Americans at risk by rolling back consumer protection laws at the state level. They are better adapted to the specific risks associated with financial products that do not fall under the definition of securities,” the appeal says.

Officials insist that the court should refuse the regulator to classify cryptoassets as securities when absence of an investment contract.

Recall that the SEC filed a lawsuit against Kraken in November 2023. The regulator's actions were criticized by both industry groups and authorities.

In February, Kraken requested that the lawsuit be dismissed. The exchange insists that crypto assets should be treated as commodities and not securities.

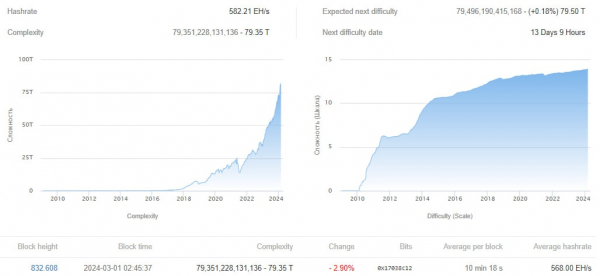

Bitcoin mining difficulty decreased by 2.9%

On March 1, 2024, Bitcoin mining difficulty reached mark at 79.35 T. Since the last date of change, the indicator has decreased by 2.9%. This is evidenced by data from BTC.com.

The current average hashrate in the Bitcoin network is 568 EH/s.

The difficulty of mining determines the required total power of equipment for mining cryptocurrency. An increase in this indicator brings the halving date of the first cryptocurrency closer. Under certain conditions, it may take place in April 2024.

The next Bitcoin mining difficulty recalculation will take place around March 15.

BIS has issued recommendations on global stablecoin agreements

The Bank for International Settlements (BIS) has issued recommendations on the regulation, supervision and monitoring of global stablecoin agreements stablecoins.

The organization described global stablecoins (GSC) as widespread “stable coins” with potential reach and use in multiple jurisdictions.

“GSCs have the potential to become systemically important in one or many countries,” the document says.

The report sets out key recommendations aimed at addressing the financial stability risks posed by GSCs both domestically and internationally.

The proposals also aim to support innovation and provide jurisdictions with flexibility in adopting domestic approaches.

Some of the key recommendations call for agencies to prepare to regulate and monitor global stablecoin agreements, with a focus on cross-border cooperation, coordination and information sharing.

The report identifies priorities for supranational authorities to ensure the effectiveness of GSC risk management systems ” especially on operational resilience, cybersecurity guarantees and AML/CFT measures on terrorist financing, as well as compliance.”

The authors of the document also addressed issues of data storage and access, rights of repayment and prudential requirements.

The document states that while stablecoins have the potential to improve the efficiency of financial services delivery, “they may also pose threats to financial stability.”

“The recommendations aim to promote consistent and effective regulation, oversight GSC and tokens that can receive this status in various jurisdictions. It also emphasizes a technology-neutral approach that prioritizes core activities and risks,” the organization summarized.