The main thing on the cryptocurrency market.

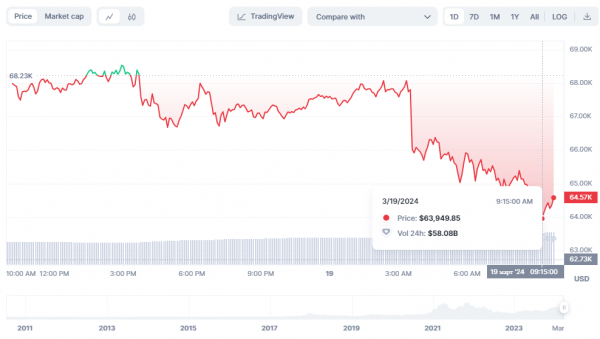

Bitcoin price dropped below $64,000

On Tuesday, March 19, the price of the first cryptocurrency fell to $63,950, after which it subsequently rose slightly. This is evidenced by data from CoinMarketCap.

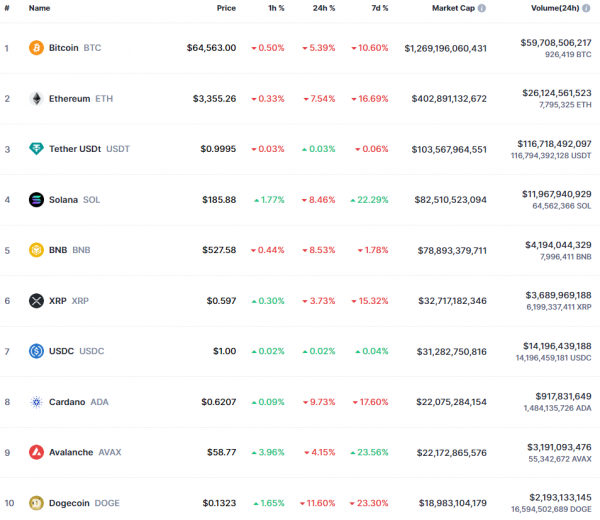

At the time of writing the news, the price of the asset is about $64,560. During the day, Bitcoin fell by 5.39%, over the week – by 10.60%.

It should be noted that most other cryptocurrencies with the largest capitalization also lost in price over the day.

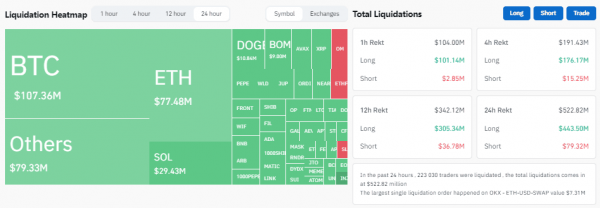

The daily volume of liquidations on the crypto market exceeded $522 million

From March 18 to March 19, 2024 year, the volume of liquidations on futures contracts on the crypto market amounted to $522.82 million. This is evidenced by CoinGlass data.

In total, 223,030 traders were subject to liquidation. In terms of losses, long positions prevail – $443.5 million. Short positions account for $79.32 million.

Bitcoin (BTC) prevails among crypto assets. Pairs with the first cryptocurrency account for about 20% of all losses due to liquidations. Next come Ethereum (ETH) and altcoins, in particular Solana (SOL), Dogecoin (DOGE) and Ripple (XRP).

Regarding crypto exchanges, the leaders are traditionally Binance and OKX. Their total share is about 70%.

Nigeria demanded from Binance the data of all users from the country

The Federal High Court in Abuja ordered the Binance cryptocurrency exchange to provide comprehensive information about all persons from Nigeria trading on her platform. Local media reported this.

The petition came from the Economic and Financial Crimes Commission, which is investigating the activities of the exchange in the country. The requested data includes the names and full transaction history of Nigerian users.

Recall that Nigerian authorities accuse Binance of financing terrorism, money laundering and manipulating the naira exchange rate. According to the local central bank, over the past year $26 billion passed through Binance alone, the sources of which cannot be accurately determined.

Previously, the exchange demanded a list of the top 100 users in Nigeria and the entire transaction history for the last six months. The platform was also obliged to settle any outstanding tax obligations.

Recall that the Nigerian government asked the Binance cryptocurrency exchange for damages in the amount of $10 billion for manipulating the naira exchange rate.

Changpeng Zhao announced his new project< /h3>

Former CEO of the Binance exchange Changpeng Zhao announced a new project called Giggle Academy. He also announced the recruitment of personnel, a small team that will work with him directly.

Judging by the announcement, the project is educational. Zhao's post says that learning on the platform will likely be done in a playful way. At the same time, users will be able to receive basic education from grades 1 to 12.

The project is non-profit. In addition, Zhao refused to answer the question whether there are plans to issue a native token.

Also, the former CEO of Binance opened a recruitment drive. According to him, the staff will be small.

Every person in the world has the right to education. Our mission is to make it fun and accessible to everyone,” says the project’s official website.

OKX will remove trading pairs with USDT in Europe – media

OKX cryptocurrency exchange will delist trading pairs pairs with USDT stableblock from Tether for clients from the EEC. This is reported by The Block.

The publication refers to an email received by one of the European traders, and cites the upcoming entry into force of the bill on the regulation of cryptocurrencies in the European Union as the reason (Markets in Crypto Assets, MiCA) The document will come into force in full on December 30, 2024.

A support representative confirmed to reporters that the “stable coin” has become unavailable to users in the EEA since March 14.

p>

MiCA obliges stablecoin operators to obtain a license from the competent authority of an EU member state and comply with the rules for ensuring the stability of their tokens.

According to the document, issuers of “stable coins” must conduct stress tests and cover 3% reserves with own capital.