Binance Research, the analytical division of the Binance cryptocurrency exchange, published a monthly market report and highlighted key trends for April.

► Read the Ministry of Finance on Instagram: the main news about investments and finance

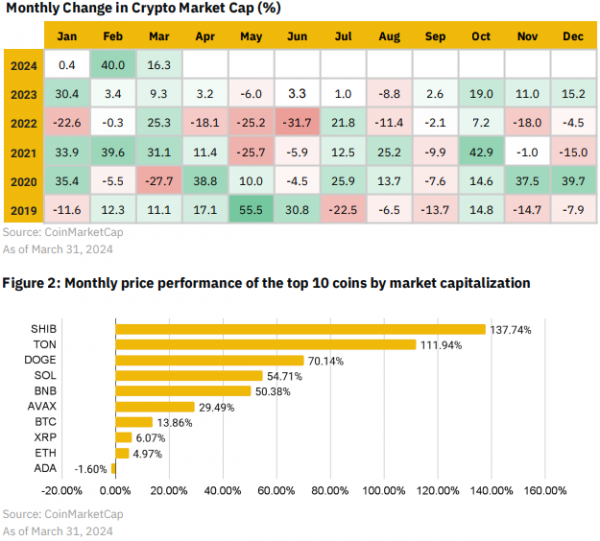

In March, the cryptocurrency market maintained positive dynamics, ending the month with a significant increase in market capitalization by 16.3%.

< p>Although inflows to spot Bitcoin ETFs slowed in the second half of the month, these funds have attracted more than $12 billion in net investment since January.

Consideration of the investment prospects of Bitcoin will continue to attract investors, so price volatility for the cryptocurrency is expected to remain relevant.

There was a significant increase among the ten largest cryptocurrencies by market capitalization, which continued the positive trend of previous months.

SHIB, TON, and DOGE saw monthly growth of 137.7%, 111.9%, and 70.1% respectively, supported by the growing popularity of meme coins on networks such as Solana and Base.

SOL and BNB performed astoundingly, rising by 54.7% and 50.4% respectively. SOL has reached new heights in terms of market capitalization and trading volume on decentralized exchanges with a record $74.5 billion.

Amid this success, Bitcoin (BTC) continued to rise, albeit at a slower rate, with a 13.9% increase and reaching new highs of over $73,000.

XRP, ETH and ADA showed less pronounced gains, with XRP and ETH increased by 6.1% and 5.0% respectively, while ADA showed a slight decline of 1.6%.

This month highlighted the dynamics and volatility of the crypto market, showing significant price fluctuations and investor activity, especially in the segment of meme coins and large cryptocurrencies such as Solana and BNB.

The decentralized finance (DeFi) market showed significant progress in March 2024, increasing its total value locked (TVL) by 14%. Among the leading blockchains, Solana and Base stand out, where TVL grew by 94% and 143% respectively.

Solana set a new record trading volume on decentralized exchanges (DEX), reaching $60 billion. Base also showed extraordinary results, setting a new record of $7.82 billion.

The popularity of meme coins has been a key factor driving growth on these platforms, highlighting the potential of these assets to drive wider adoption in the DeFi space. Increasing activity and trading volumes in DeFi highlight the dynamism of the market and increasing interest in innovative financial technologies.

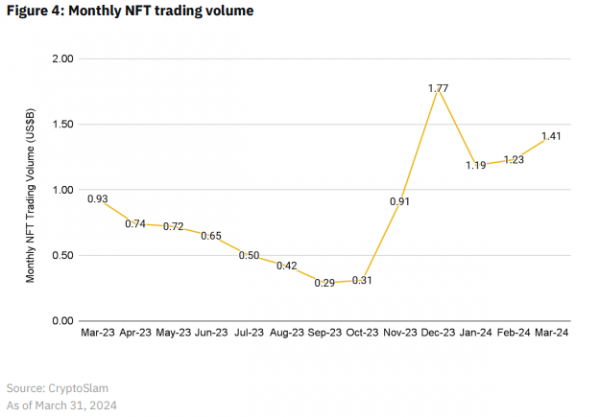

The NFT market showed positive trends with an increase in total sales by 14.6%, reaching $1.41 billion.

< p>Ordinals and NodeMonkes saw impressive month-on-month growth of 170% and 140%, respectively.

Sales of Pandora, the first NFT collection to use the ERC-404 standard, experienced a significant decline of 78% in March. This highlights the shift in interest and value in the world of digital art and collections.

In terms of sales volume, Bitcoin topped the list with $514 million, followed closely by Ethereum with $489 million and Solana with $243 million.

< p>Other networks showed significantly lower sales volumes, highlighting the dominance of the three leaders in the NFT market.