Mainly on the cryptocurrency market.

Crypto exchange CatalX has suspended trading and withdrawal of funds

Canadian cryptocurrency exchange CatalX has frozen trading, deposits and withdrawals after a “security breach”. This is stated in the press release.

Management suspects that an employee may be involved in the incident. The platform admitted the loss of part of the cryptocurrency assets, but did not specify the amount.

The company involved Deloitte LLP experts in the investigation.

On December 21, 2023, the Alberta Securities Commission ordered the company to cease trading and began an investigation into the platform.

Argentines may be allowed to declare crypto assets without indicating their source of origin.

December 27, 2023 A bill “On the foundations and starting points of the freedom of Argentines” was submitted to the National Congress of Argentina for consideration. Among other things, it contains certain amendments to the Tax Code regarding crypto-assets.

These are set out in the section on “regularization” of assets. Residents of the country are encouraged to declare assets, including cryptocurrency, without having to indicate their source of origin.

Those who take advantage of this opportunity before the end of March 2024 will pay a fixed fee of 5% of income received. If the investor fills out the declaration later, the rate will be higher. From April to the end of June 2024 – 10%, until September and later – 15%.

According to the authors of the bill, this will allow residents to partially withdraw their income from the shadow sector.

At the end of December 2023, the Argentine authorities issued a decree “Fundamentals for the reconstruction of the Argentine economy.” Among other things, it allows you to conclude contracts in those assets that are not recognized as a means of payment in the country.

According to Argentine Foreign Minister Diana Mondino, counterparties on the local market can conduct mutual settlements both in bitcoins and in “liters” milk and kilograms of meat.”

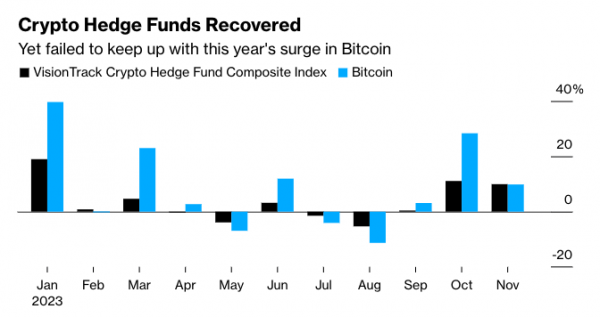

Cryptocurrency hedge funds have earned 44% this year – Bloomberg

In the past 12 months, cryptocurrency hedge funds recorded an average increase in asset value of 44%, resuming after a decline of 55% in 2022. Bloomberg reports this.

According to a Pantera Capital representative, the company's liquid token fund has grown by almost 80%. One of the institution's biggest holdings is the dYdX coin. The share of Bitcoin and Ethereum together is less than 40%.

Stoka Global, which invests primarily in altcoins, gained 268% as of November 30.

Although the average return of hedge funds is far from With Bitcoin reaching 150%, many industry participants expect accelerated growth in the future.

Thanks to the first cryptocurrency's positive performance, potential investors are once again “answering phone calls from fund managers as hedging remains cheap,” he added.

Bloomberg reporters highlighted that the crypto fund index had the most impressive performance compared to other traditional trackers their strategies.

FTX debtors proposed to evaluate customer claims at 2022 market prices

On December 27, 2023, the debtors of the FTX exchange filed a petition in the US Bankruptcy Court. It refers to a “fair and reasonable valuation” of user claims based on market prices as of November 11, 2022.

The proposal includes prices for approximately 500 digital assets at the time FTX filed for bankruptcy.< /p>

“The plan provides for the calculation of claims on digital assets by converting the value of the asset into cash on the date of filing the claim using the rates specified in the digital asset conversion table and making distributions in cash,” the proposal says.

In particular, the debtors proposed to value Bitcoin at $16,871, Ethereum at $1,258, and the SOL token at $16.24. Note that at the time of writing, Bitcoin is trading around $42,500, and Ethereum is trading at $2,350. Since filing for bankruptcy, the SOL coin has grown almost 7 times and is trading at $107, according to TradingView.

According to the statement, the debtors used data from the analytical service Coin Metrics to estimate the value of digital assets. Parties involved in a bankruptcy case may file objections until January 11, 2024. A hearing in the case is scheduled for January 25. The motion to order the assessment of creditors' claims based on the proposed prices is pending court approval.

Some FTX clients objected to the proposed plan. One of them called such an assessment “fraud” and said that the case could drag on for several years.