The main thing on the cryptocurrency market.

The Canadian regulator fined Binance $4.4 million for violating AML requirements

The Financial Transactions and Reports Analysis Center of Canada (FINTRAC) fined the Binance cryptocurrency exchange $4.4 million for violating legislation aimed at combating money laundering.

In 2023, the regulator inspected the company for compliance. During the investigation, FINTRAC discovered that Binance does not have a license to operate as a foreign money services service (FMSB).

According to FINTRAC, companies have been given the opportunity to register as an FMSB on numerous occasions. However, the platform did not do this within the time limits required by law.

FINTRAC representatives also noted that the company did not provide Canadian authorities with information about virtual currency transactions exceeding 10,000 Canadian dollars ($7,300). The department counted 5,902 transactions of this kind for which the exchange did not transmit data.

On May 7, 2024, the financial regulator officially fined Binance Holdings Ltd for violating AML legislation and operating without a license.

Hacker with $71 million worth of stolen WBTC returned $152 thousand to the victim as compensation

Hacker , who stole 1155.2 WBTC using the spam transaction method, returned part of the funds to him after communicating with the victim user. The attacker decided that compensation of 4.2% of the amount needed to return the assets would be enough. This is reported by Incrypted.

On May 3, 2024, an unknown trader lost WBTC for a total amount of $68 million. By the time the news was written, the rate of the asset had increased, and the mentioned volume of funds was already estimated at $71 million.

Cyvers experts noted that the user allegedly became a victim of a fraudulent scheme using spam transactions (address poisoning). The victim trader lost 97.65% of his funds, according to analysts.

The victim demanded that the hacker return 90% of the stolen assets, offering the scammer to keep 10% as a reward. After some time, the attacker got in touch via an incoming data message (IDM).

The hacker invited the victim’s Telegram account twice, after which he received a response from the victim. Then the scammer sent the trader 51 ETH, which at the time of transfer of the asset was estimated at $152,000.

The victim was not satisfied with this amount of compensation. He said that now there is “no turning back” and he will have to hunt down the hacker. According to the user, the movement of funds will lead investigators to the attacker and he will not be able to escape.

EU regulator will consider adding cryptocurrencies to the investment market

The European Securities and Markets Authority (ESMA) is conducting a survey on whether certain asset classes, in particular cryptocurrencies, should be included in the Collective Investments in Securities Directive (UCITS).

UCITS is a pan-European directive under which collective investment funds are launched in the EU.

The document states that ESMA is “asking stakeholders to answer a series of questions to obtain views on how certain asset classes may pose risks to retail investors.” In particular, we are talking about cryptocurrencies.

DLNews noted that if the latter are approved as an asset class, this will be a step for wider access to cryptocurrencies through UCITS funds – a securities market estimated at 12 trillion euro.

“If ESMA is convinced of this, then this is the latest step towards the introduction of crypto assets in Europe, a potential game changer,” said financial regulation expert Sean Tuffy.

Trading volumes on crypto exchanges fell for the first time in seven months. h3>

The total volume of spot and derivatives cryptocurrency markets fell by 43.8% in April to $6.58 trillion after a record in March ($9.12 trillion). This data was reported in CCData.

The positive trend was interrupted after six months.

Experts explained the reversal of the trend by the escalation of geopolitical tensions and a slowdown in the inflow of funds into spot ETFs. Optimism was also sparked by the diminishing likelihood of Fed policy easing this year.

Crypto derivatives turnover fell by 47.7%, to $4.57 trillion; spot contracts – by 32.6%, to $2.01 trillion.

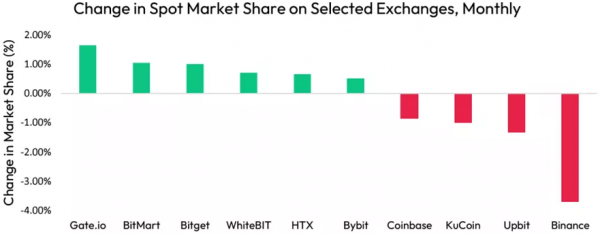

Binance's share decreased by 2.41%, to 41.5%, including in the spot market – by 3.69%, to 33.8% ($679 billion).

Gate.io, BitMart, BitGet, WhiteBit, HTX and Bybit managed to strengthen their positions.