What is Bitcoin halving and how the price will change in 2024 (photo: pixabay com) Author: Special Project

Halving (English: halving) – halving the reward to miners for mining cryptocurrency. It takes place approximately every four years.

Read more about what halving is and how it can affect the cost of the first cryptocurrency in 2024 in the material from RBC-Ukraine.

The algorithms of cryptocurrencies such as Bitcoin do not allow printing an endless amount of money. Therefore, the issue of Bitcoin is limited and amounts to 21 million coins.

When Bitcoin first appeared, the reward for receiving a block was set at 50 bitcoins. To stimulate demand and prevent runaway inflation, a halving mechanism was established that occurs every 210,000 blocks mined.

According to this mechanism, the number of new bitcoins created with each mined block is halved. Miners also receive half the number of Bitcoins per block compared to the previous period.

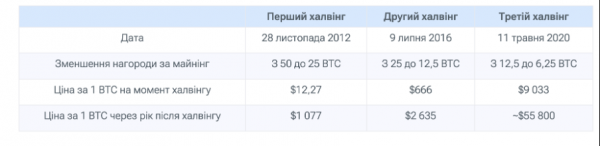

Thus, the first Bitcoin halving took place in November 2012, when the reward for creating a block decreased from 50 to 25 bitcoins.

The second halving occurred in July 2016, when the reward was reduced to 12.5 bitcoins.

During the third halving in May 2020, the reward was again halved to 6.25 Bitcoin.

Therefore, the next halving is expected in 2024.

Interesting fact: Halving was started by the creator of Bitcoin, Satoshi Nakamoto. It will continue until the maximum number of digital coins is mined – 21 million bitcoins. This will probably happen in 2140.

Why does halving happen?

Halving has several purposes.

First, the Bitcoin halving aims to create scarcity. Scarcity is a deliberate feature of Bitcoin designed to imitate precious metals such as gold. As precious metal reserves decrease, the difficulty of mining increases and demand increases.

Secondly, it preserves the price of Bitcoin and is part of the inflation control mechanism. Bitcoin becomes increasingly scarce over time, making it more resistant to inflation.

Third, it incentivizes miners to hold onto Bitcoin as their reward decreases and they can expect the price to rise in the future.

In addition, halving encourages miners to increase efficiency, strengthening the security of the network.

Implications for the market

Bitcoin halving events have far-reaching consequences that ripple throughout the cryptocurrency ecosystem.

One of the most noticeable consequences is their impact on the behavior of miners. As mining rewards decrease, miners face decreased income.

This often pushes them to look for more efficient hardware and join mining pools to maintain profitability.

Increased competition and possible consolidation of mining power could affect the decentralization of the network, which is one of the core principles of Bitcoin.

In addition, a decrease in the rate of creation of new bitcoins may affect the dynamics of supply and demand.

Halving and Bitcoin price in 2024

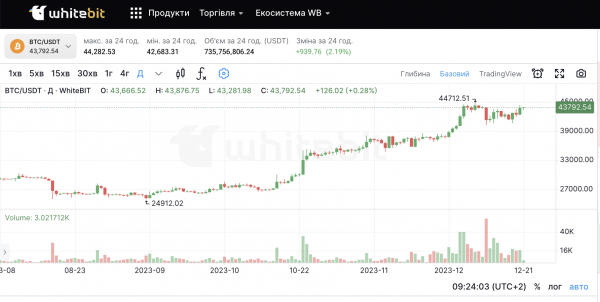

Today, the current BTC rate, according to one of the largest European crypto exchanges WhiteBIT, is about 44 thousand dollars.

In total, since the beginning of 2023, the Bitcoin rate has grown by almost 161%, over the past three months – by more than 66%, over the last month – by a little more than 18%.

The next Bitcoin halving is scheduled for around mid-April 2024. It is expected that he will again reduce the block reward, this time to 3.125 Bitcoin per block.

After this, according to the forecast of Standard Chartered Bank, Bitcoin has the potential to rise in price to a record $100 thousand per coin by the end of 2024.

Historical data also shows that the cryptocurrency takes about 500 days to reach a new all-time high after the halving.

However, the cost of cryptocurrency and crypto markets in general is influenced by many factors. Therefore, whether you are a Bitcoin supporter or just an observer, understanding the Bitcoin halving is key to determining the long-term value of this cryptocurrency.

How to prepare for halving

As noted above, halving may lead to an increase in the price of Bitcoin due to a decrease in new supplies. Therefore, some investors are considering investing in Bitcoin.

In this context, it is important to remember that cryptocurrencies are high-risk assets and you should study the market in detail and understand its risks before investing. To do this, follow the news. Stay up to date with the latest Bitcoin halving events. Read articles and follow expert opinions to get different points of view regarding the impact of halving on the price of Bitcoin.

At the same time, any financial transactions should be made only through proven and reliable crypto exchanges. Use secure wallets with two-factor authentication and strong passwords. For example, we previously published stories of Ukrainians who started investing in Bitcoin on the WhiteBIT crypto exchange. WhiteBIT stores 96% of digital assets on cold cryptogamers and also uses a WAF (web firewall) to protect against cybercriminals.

To summarize, Bitcoin halving is not only about reducing block rewards or increasing the value of the cryptocurrency in the long term. It's about maintaining scarcity, controlling inflation, and navigating the complex interplay of market forces.

Read urgent and important messages about Russia's war against Ukraine on the RBC-Ukraine Telegram channel.