The main thing on the cryptocurrency market.

The cost of Bitcoin exceeded $48,000 for the first time in two years

On Friday, 9 February, in the evening the price of the first cryptocurrency exceeded $48,000 – for the first time since March 2022. This is evidenced by data from CoinMarketCap.

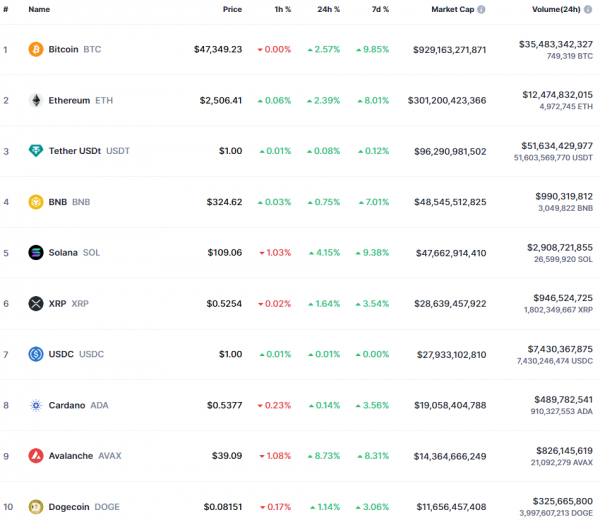

At the moment, the cost of Bitcoin was $48,152, after which the price of the asset rolled back. Today, February 10, at the time of writing the news, Bitcoin is trading at a level of about $47,350. Over the day, the asset has risen in price by 2.57%, over the week – by 9.85%.

As for other cryptocurrencies with the largest capitalization, they also showed growth over the last 24 hours and 7 days. It is worth noting that the price of Ethereum has increased to $2,500.

BlackRock is ready to increase the share of bitcoin in its portfolio

Financial giant BlackRock is ready to increase the share of the first cryptocurrency in its portfolio. This was reported by The Wall Street Journal with a link to the company's chief investment officer for global fixed income, Rick Rieder.

According to him, Bitcoin now makes up only a small part of the firm’s total funds under management. However, the situation may change along with a change in society's attitude towards this asset, notes Reader.

A BlackRock representative believes that over time, people will begin to perceive the first cryptocurrency more calmly. This gives Bitcoin a chance to become a large part of the asset allocation system, Reeder emphasizes.

He noted that the company is monitoring the situation on the market and is ready to increase the amount of Bitcoin in the investment portfolio.

“If industry receptivity grows, then we have more tools that people can use to feel more comfortable owning, buying, selling and liquidating cryptocurrency,” Reeder said.

Hackers spoofed Blockchain email .com for phishing

Employees of the UK National Fraud Bureau (NFIB) reported blocking 43 fake domains associated with phishing.

Among others, law enforcement officers discovered a fake email address allegedly belonging to the cryptocurrency exchange Blockchain.com. With its help, attackers contacted users of the platform.

NFIB did not specify how many clients on the exchange became victims of hackers.

Among other blocked domains were “actionfraud.info” and “department- fraud.com”, simulating government portals for tracking cyber fraud.

Genesis entered into a settlement agreement with the US authorities

Bankrupt crypto lender Genesis Global Trading has reached a settlement with New York City Attorney General Letitia James. This was reported by Bloomberg with a link to court documents.

The source claims that Genesis has settled a lawsuit filed by a top New York official. It alleged that the crypto lender provided incomplete information to participants in the Gemini Earn program, which was produced jointly with Gemini.

It is reported that the parties have reached an amicable agreement. Under the terms of the agreement, assets that could have been turned over to the state will be returned to former Earn customers and other Genesis creditors. The preliminary agreement must be approved by a bankruptcy judge.

The document states that New York authorities have offered to support Genesis creditors in the Chapter 11 repayment process. This comes after the crypto lender reached a separate agreement with the Commission on US Securities and Exchange Commission (SEC) for $21 million.

The agreement emphasized a commitment to value digital assets closer to current market value, and the majority of Genesis' creditors supported the initiative.

However, the liquidation plan met resistance from conglomerate Digital Currency Group (DCG). The company said the proposed scheme could give some creditors “an unfair advantage during the Chapter 11 process.”

Genesis is expected to file a liquidation plan with Judge Sean Lane on Feb. 14, 2024. The presentation will include seeking approval for both the New York settlement and the overall liquidation strategy, the source said.

As a reminder, after the crash, FTX Genesis filed a statement of inability to pay the liability. The suspension of payments directly impacted Gemini, one of the platform's largest creditors.

Long negotiations followed between Genesis and its parent company Digital Currency Group. Ultimately, in July 2023, Gemini sued DCG, accusing it of fraud.