Binance Research, the analytical division of the Binance cryptocurrency exchange, presented a report for the first quarter of 2024, which describes in detail the state of the cryptocurrency market.

► Read page Ministry of Finance on Facebook: major financial news

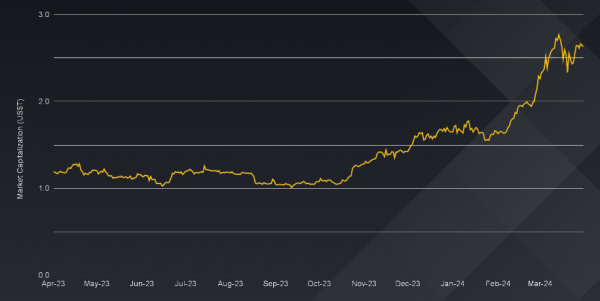

The first quarter of 2024 was a turning point for the crypto industry thanks to the successful launch of spot Bitcoin ETFs, which attracted more than $12 billion in net proceeds. This contributed to the rapid growth of the total market capitalization by 60% compared to the previous quarter.

Indicators of the largest cryptocurrencies by market capitalization

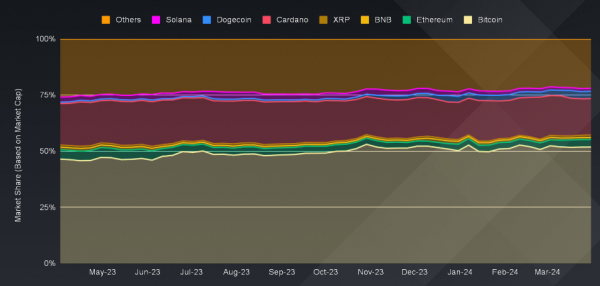

The three market leaders maintained their positions throughout 2022, 2023 and early 2024. At the same time, meme coins experienced a resurgence in popularity.

DOGE and SHIB were among the top ten cryptocurrencies of the first quarter of 2024, showing impressive growth of 140% and 190% respectively.

Solana continued to be one of the most successful cryptocurrencies, supported by “wealth effects” in its ecosystem, which attracted significant flows of users and capital.

In addition, TON regained its momentum caused by market expectations about the network’s potential audience and the expansion of its ecosystem.

With the successful launch of spot Bitcoin ETFs, BTC remained the center of market attention in the first quarter of 2024, showing a 1.6% increase in its dominance. At the same time, Ethereum continued to show a slight decrease in dominance.

BNB saw a noticeable increase in demand, increasing its dominance by 0.47%, which was partially driven by several Binance Launchpool events.

Technological progress in Layer 1 and Layer 2

In Q1 2024 year, the number of transactions on the Solana network showed impressive results thanks to active trading of meme coins and the steady growth of its ecosystem.

Near and Ethereum showed moderate growth in active addresses compared to the previous quarter, increasing by 42 and 24% respectively, while addresses on BNB Chain remained flat during Q1, only showing some growth at the end of the quarter.

Arbitrum maintained its position as the leader among L2 networks in TVL, ending the quarter with an 80% increase compared to the previous quarter and reaching TVL at the end of the quarter of approximately US$20 billion.

Base has widened its gap with OP Mainnet, driven by the rise of meme coin trading on the network. Additionally, Starknet experienced rapid growth in TVL, surpassing $300 million at the end of the quarter following the launch of its token in February.

Expanding Horizons in the DeFi Sector

The total value of assets locked in the decentralized finance (DeFi) sector grew by 70.6% to reach $92 billion. This surge was fueled by liquid staking and re-staking, attracting investment in reward farming and airdrops.

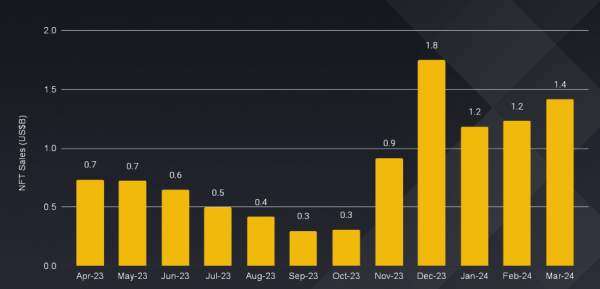

Activation of the NFT market

Total NFT sales increased by 27%, thanks to increased activity on the Bitcoin, Ethereum and Solana platforms. This indicates a growing interest in this type of digital asset. Popular collections driving this growth include Bitcoin Ordinals, NodeMonkeys, Pandora and Mad Lads.

Dominance on the Gaming Field

The gaming industry landscape has been led by BNB Chain, Ethereum and Polygon. which together contain about 70% of the market share by number of games. This indicates the consolidation of the gaming market on these platforms.