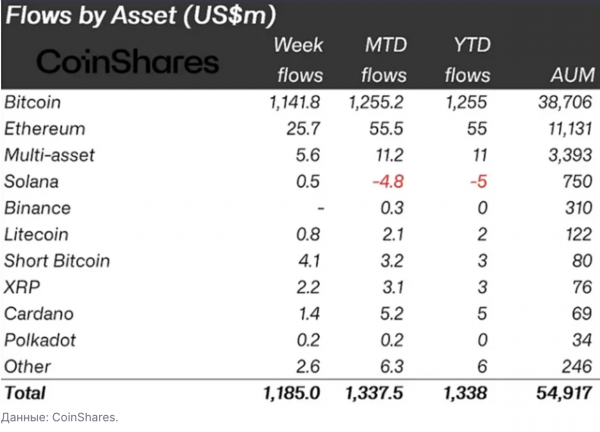

Inflows into cryptocurrency investment products from January 6 to January 12 increased to $1.19 billion, which is close to the historical high of $1.5 billion during the launch of futures ETFs in October 2021. This is stated in the CoinShares report.

►Subscribe to the Ministry of Finance page on Facebook: main financial news

Trading turnover reached a historical high of $17.5 billion. For comparison, in 2022 the average figure was $2 billion.

This value is equivalent to almost 90% of the trading volume of TradFi exchanges, although this ratio typically varies in the range of 2-10%.

Investors have invested $1.16 billion in Bitcoin-related instruments. Receipts over the last nine weeks are equivalent to 3% of AUM.

In structures that allow opening shorts on the first cryptocurrency, an inflow of $4.1 million was recorded (a week earlier – $0.9 million).

Read: Investors in Bitcoin is now under US protection: what does this mean

673=”246″ data-gtm-vis-has-fired1698882673=”1″ data-gtm-vis-recent-on-screen1698882673=”246″ data-gtm-vis-total-visible-time1698882673=”100″ itemprop= “articleBody” style=”padding: 0px; box-sizing: border-box; margin: 0px; font-family: roboto, sans-serif; color: rgb (45, 45, 45); font-size: 16px; background -color: rgb (255, 255, 255); text-align: center;”>

Ethereum funds raised $25.7 million (in the previous reporting period – $29.6 million).

Investors invested $2.2 million, $1.4 million and $0.8 million, respectively, into instruments based on XRP, Cardano, Litecoin.

Funds based on Solana, after an outflow of $5.3 million the previous week, attracted $0.5 million.

Recall

Earlier, the Ministry of Finance wrote that on January 10, the SEC approved 11 applications from spot issuers Bitcoin ETF, we've been waiting for this for 10 years. The commission has denied companies registration for such a trading instrument many times before.

The approval of 11 spot Bitcoin ETFs has sparked optimism among investors about the potential approval of an Ethereum ETF. Against this background, there was a sharp increase in the rate of the leading altcoin.