The main thing on the cryptocurrency market.

Goldman Sachs clients have renewed interest in digital assets and are investing in Bitcoin

Representatives of the investment bank Goldman Sachs said that their clients have renewed interest in the field of digital finance. We are talking about both the existing audience and new market players. Bloomberg reports this.

According to company analysts, the industry is attracting the attention of large hedge funds amid the launch of spot Bitcoin ETFs. The US Securities and Exchange Commission (SEC) approved this asset class in January 2024, and since then crypto funds have seen record inflows of capital.

“The recent approval of ETFs has sparked renewed interest and activity from our audience. Many of the largest clients are working in this area or are exploring the possibility of participating in the area,” said Goldman Sachs head of digital assets in the Asia-Pacific region Max Minton.

The company began providing investment services in the crypto sector in 2021. Goldman Sachs offers clients settled options on Bitcoin and Ethereum, as well as listed cryptocurrency futures on the Chicago Mercantile Exchange (CME).

Bank representatives noted that traditional hedge funds are of greatest interest. At the same time, their attention is mainly focused on Bitcoin products. The first cryptocurrency remains the undisputed leader in terms of financial investments.

However, the balance may change if the SEC approves applications for registration of spot Ethereum-ETFs. As is the case with investment products based on Bitcoin, they can attract the attention of large players, according to Goldman Sachs.

Capitalization of the parody meme token BODEN exceeded $200 million

The market capitalization of the meme cryptocurrency Jeo Boden (BODEN), which parodies US President Joe Biden, reached $220 million on the Solana network, according to GeckoTerminal data.

Launched on March 9, the coin is only available on the decentralized exchange Solana Raydium and is not yet listed on any centralized platform.

“Boden is the 46th president of Solana. His account is three hundred trillion million billion dollars. This wallet belongs to both Geo Boden's treasury and the community. Any funds donated will be used for marketing, listings, giveaways, etc.,” says the project’s website.

The developers also reminded that BODEN “has no intrinsic value” and “no financial benefit should be expected from it.”

The asset became part of the meme frenzy on Solana. In parallel with it, other parody tokens of celebrities such as Danold Tromp and Olen Mosk appeared.

Binance will stop supporting USDC on the Tron blockchain

Next week, on April 5, the Binance cryptocurrency exchange will stop accepting deposits and withdrawals from USDC stablecoins issued on the Tron blockchain. The platform took this step a month after the issuer company Circle refused to support the asset on this network.

Company representatives then explained that the decision was “the result of a company-wide approach that included business organization, compliance and other functions.”

The exchange will continue to accept deposits and withdrawals of funds in USDC issued on other networks.

Trading conditions for pairs denominated in the “stable coin” will remain unchanged.

p>USDC is supported on 15 blockchains. Among them are Algorand, Arbitrum, Avalanche, Base, Celo, Ethereum, Flow, Hedera, NEAR, Noble, OP Mainnet, Polkadot, Polygon PoS, Solana and Stellar.

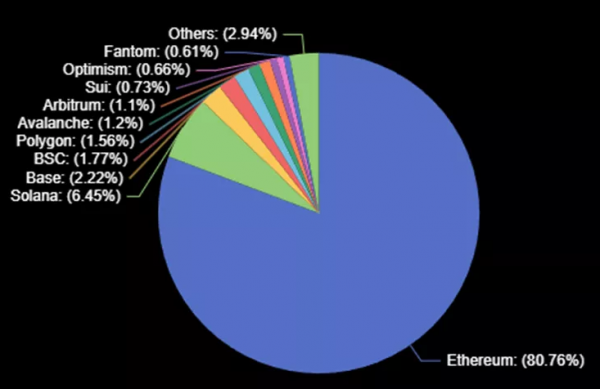

According to DeFi Llama, most of USDC ( 80.76%) circulates on Ethereum, followed by Solana (6.45%) and Base (2.22%). Tron issued stablecoins in the equivalent of $172.3 million (0.56%). According to this indicator, the network ranks 10th.

SEC will go to court to collect a $2 billion fine from Ripple Labs

Commission on US Securities and Exchange Commission (SEC) wants to collect a fine of $2 billion from Ripple Labs. This was stated by the head of the legal department of Ripple, Stuart Alderoti.

According to the lawyer, on March 26, 2024, the regulator will present documents containing the essence of the claim. They are part of a multi-year dispute between the SEC and Ripple Labs.

“Our response will be filed next month. We have seen more than once that the regulator uses erroneous, incorrectly formulated statements. Instead of faithfully applying the law, the SEC continues to seek to intimidate Ripple and the industry as a whole,” Alderoti wrote.

For its part, Ripple CEO Brad Garlinghouse said the SEC has “repeatedly acted outside the law.” . He also reproached the head of the Commission, Gary Gensler, for “insufficient attention to the case of Sam Benkman-Fried.”

Recall that in July 2023, Ripple Labs won a partial victory in a long-term lawsuit against the SEC. The court concluded that the sale of the XRP token through exchanges does not constitute an offering of securities.

Gary Gensler subsequently stated that the SEC was dissatisfied with the outcome of the Ripple Labs trial and would continue to put pressure on crypto companies. The regulator called it a mistake and confirmed plans to appeal.