Last news

What is “main character energy” and why is it Gen Z’s new philosophy

What is “main character energy” and why is it Gen Z’s new philosophy

How to pray for a soldier on the front line: texts and tips

How to pray for a soldier on the front line: texts and tips

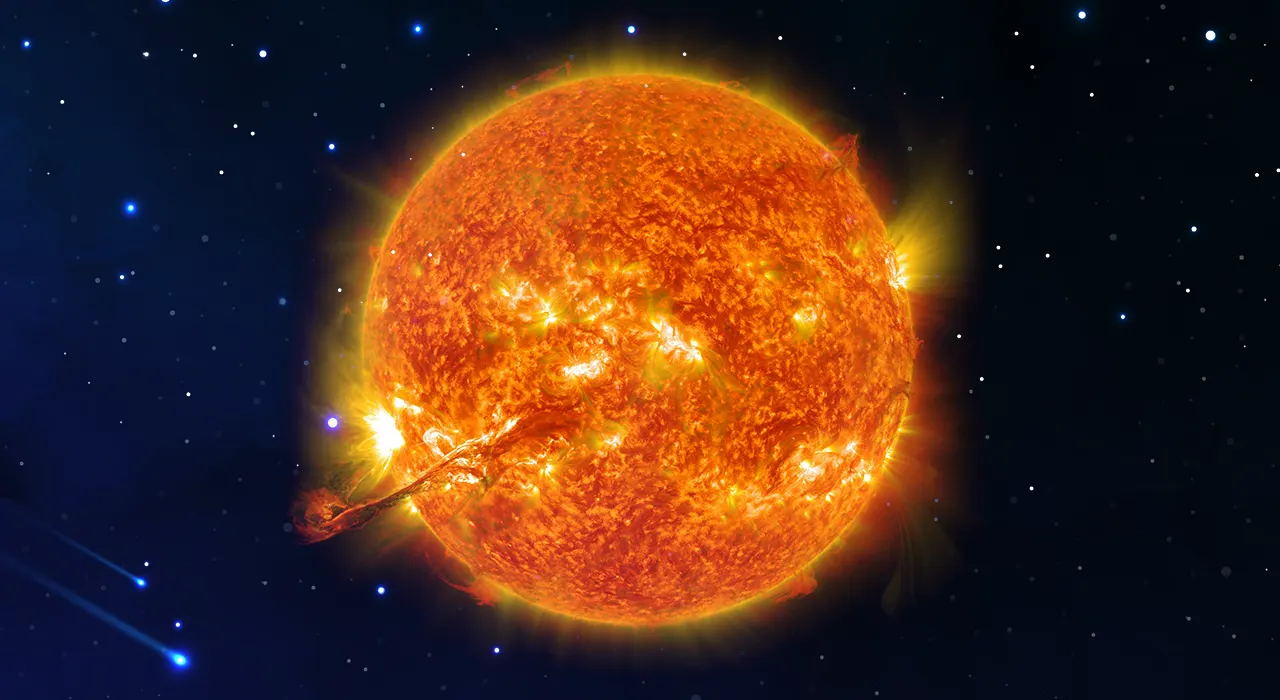

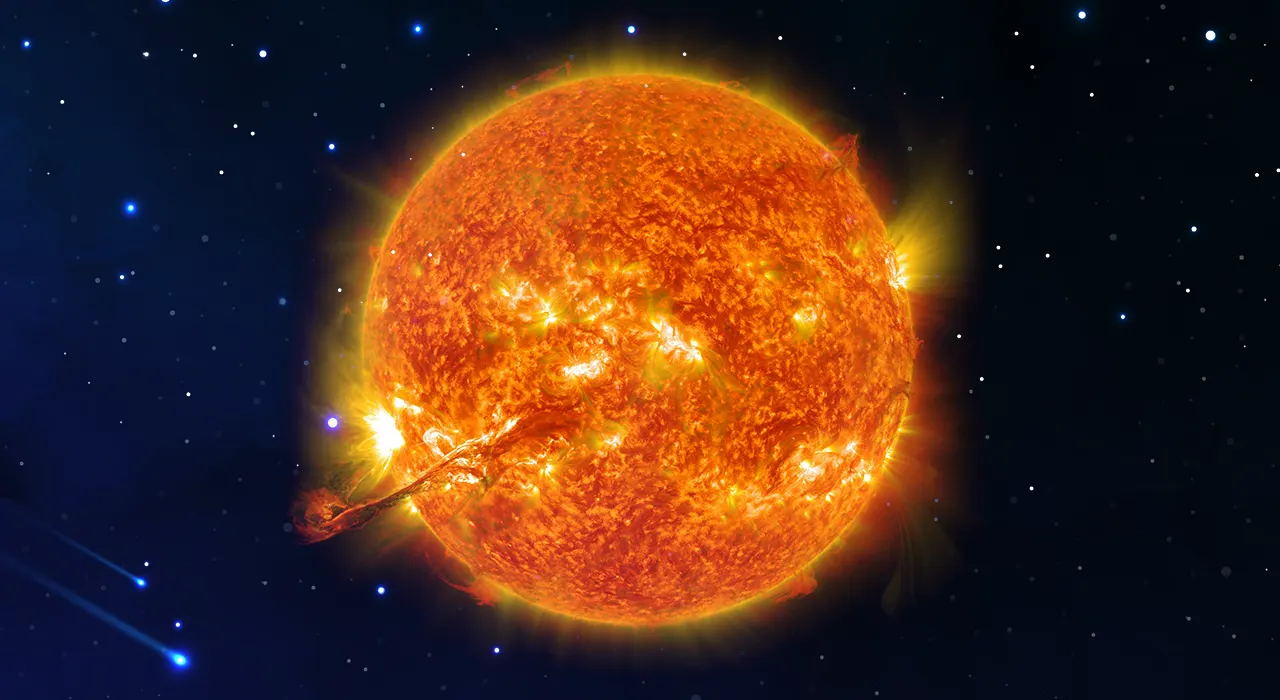

Should we fear the magnetic storm on July 11, 2025?

Should we fear the magnetic storm on July 11, 2025?

What Awaits Every Zodiac Sign on July 11: Daily Horoscope

What Awaits Every Zodiac Sign on July 11: Daily Horoscope

Alena Omovych: who she is, what is known, and how much the Ukrainian OnlyFans model earns

Alena Omovych: who she is, what is known, and how much the Ukrainian OnlyFans model earns

What is “main character energy” and why is it Gen Z’s new philosophy

What is “main character energy” and why is it Gen Z’s new philosophy

How to pray for a soldier on the front line: texts and tips

How to pray for a soldier on the front line: texts and tips

Should we fear the magnetic storm on July 11, 2025?

Should we fear the magnetic storm on July 11, 2025?

What Awaits Every Zodiac Sign on July 11: Daily Horoscope

What Awaits Every Zodiac Sign on July 11: Daily Horoscope

Alena Omovych: who she is, what is known, and how much the Ukrainian OnlyFans model earns

Alena Omovych: who she is, what is known, and how much the Ukrainian OnlyFans model earns