Last news

How to Properly Use Hair Conditioner and Balm

How to Properly Use Hair Conditioner and Balm

Trump Increases Pressure on Russia as U.S. Signs Strategic Deal with Ukraine

Trump Increases Pressure on Russia as U.S. Signs Strategic Deal with Ukraine

How to Choose the Perfect Shampoo for Your Hair Type

How to Choose the Perfect Shampoo for Your Hair Type

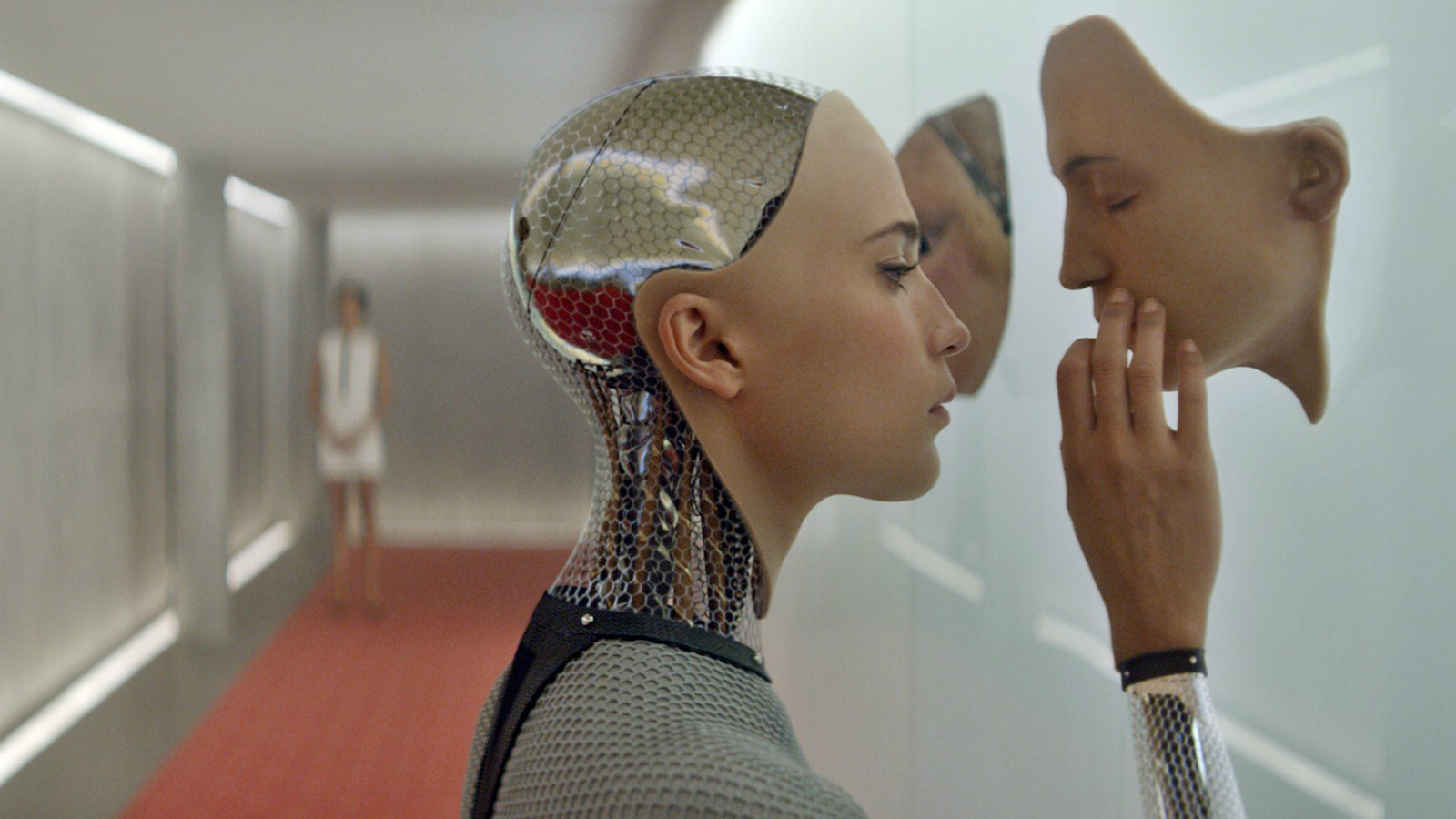

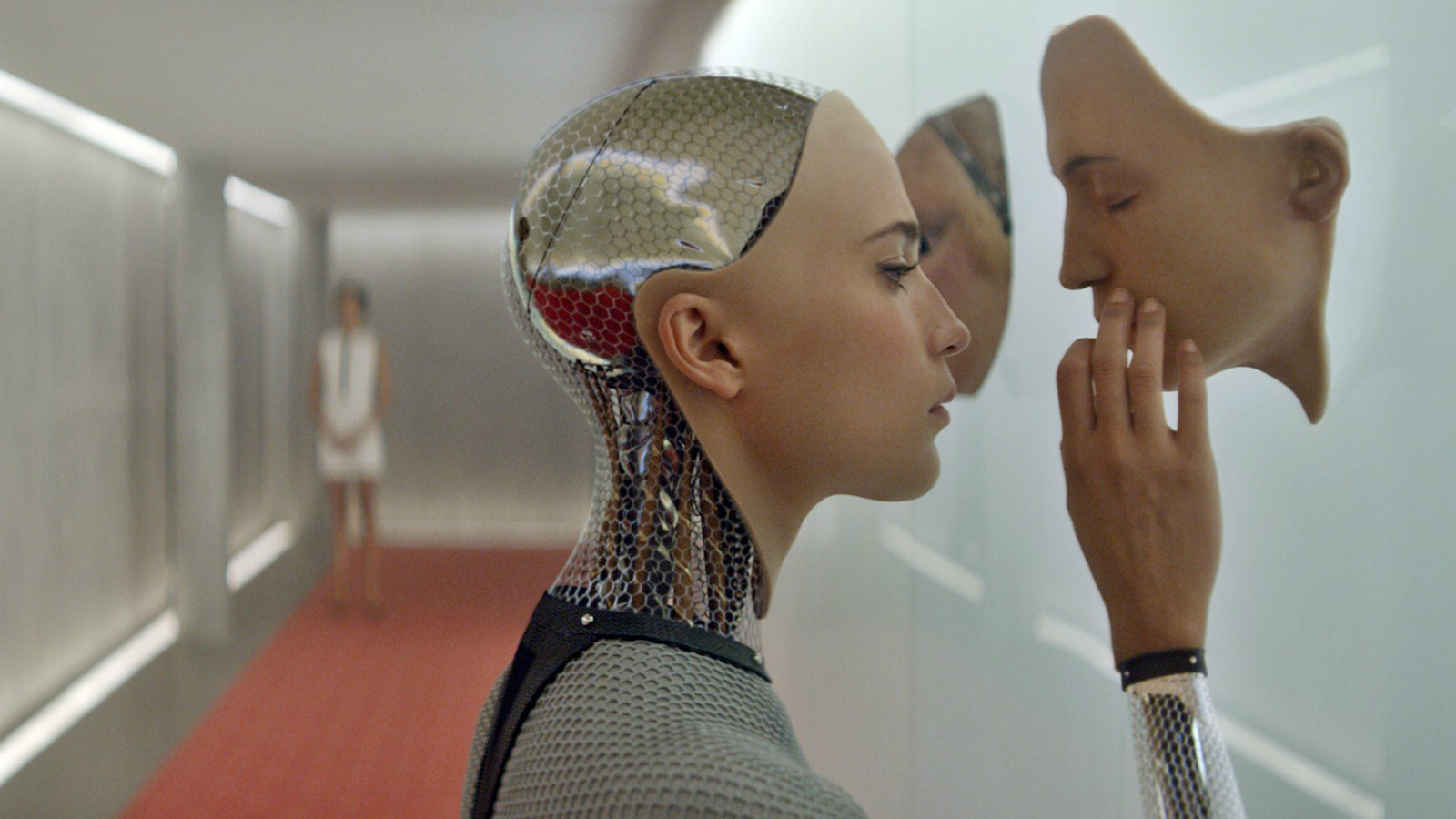

Israeli Scientists Develop Highly Sensitive Artificial Skin for Robots

Israeli Scientists Develop Highly Sensitive Artificial Skin for Robots

How to Get Rid of Dandruff at Home: Tips and Remedies

How to Get Rid of Dandruff at Home: Tips and Remedies

How to Properly Use Hair Conditioner and Balm

How to Properly Use Hair Conditioner and Balm

Trump Increases Pressure on Russia as U.S. Signs Strategic Deal with Ukraine

Trump Increases Pressure on Russia as U.S. Signs Strategic Deal with Ukraine

How to Choose the Perfect Shampoo for Your Hair Type

How to Choose the Perfect Shampoo for Your Hair Type

Israeli Scientists Develop Highly Sensitive Artificial Skin for Robots

Israeli Scientists Develop Highly Sensitive Artificial Skin for Robots

How to Get Rid of Dandruff at Home: Tips and Remedies

How to Get Rid of Dandruff at Home: Tips and Remedies